Manager Insights

Puleng Kgosimore

STANLIB Multi-Manager:

Portfolio Research Analyst

The results/outcome of a survey conducted on transformation within local investment teams

Key points

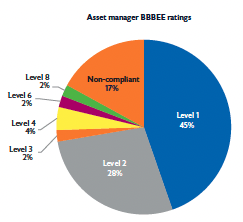

- 73% of our survey respondents (47) are level 1 and level 2 BBBEE contributors.

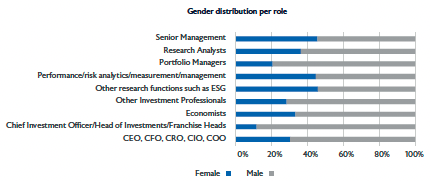

- Only 26.5% of contributors to investment decision-making are female, with better representation in senior noninvestment roles.

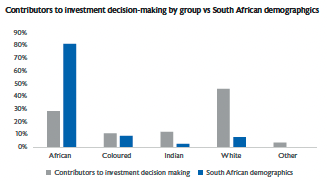

- Our perception is that race diversity has improved with 51% of investment decision makers being people of colour. But there is still a large gap in the context of South Africa’s demographics.

Transformation at different levels – but there are gaps

Although transformation is there to pave way for inclusive growth and participation by all, it is more so for those who were previously disadvantaged. There are several positive stories of women or people of colour being appointed to senior roles such as the CEO or Head of Investments. However, there is not nearly enough of these appointments or specifically, appointments within investment teams, to have moved the dial materially. The target should be an asset management industry where senior management and investment teams closely resemble the demographics of South Africa.

‘We treasure what we measure’ and in that context the Broad-based Black Economic Empowerment (BBBEE) targets became a focal point of asset managers, with 73% of asset managers being BBBEE level 1 or level 2 contributors. 17% of managers are non-compliant – most of these managers are those that we would refer to as boutiques managers.

We believe that our survey takes a deeper look into diversity and inclusion by assessing the demographics of senior management and contributors to investment decision making, namely chief investment officers (CIOs), portfolio managers (PMs) and analysts.

- Only 26.5% of women contribute to investment decision-making.

- Approximately 80% of portfolio managers are men.

- Only 12% of CIOs are women.

- There are six smaller asset managers that do not have a single woman in their businesses.

When assessing race demographics at a high level, it might appear that transformation has improved with 51% of contributors to investment decision-making being people of colour. However, the gap from an African perspective is stark, with only 28% contributing to investment decision making.

From our discussions, some managers cited time as a limiting factor to implementing transformation objectives in their businesses. This is due to issues such as a high staff retention or low team turnover. Scarcity of senior talent, especially of women has also been cited as reasons for not achieving gender parity or transformation in investment teams.

*Other (AM) largely represents the foreign nationals in the investment teams.

It is disappointing to see that some of the larger asset managers continue to struggle with diversity in their investment teams, with white professionals largely making the investment decisions. These are the institutions that should be championing this level of transformation given their access to resources. The smaller managers that managed to achieve this balance were those that focused on being transformed businesses from the onset, but still with diversity in their teams. By contrast there are four smaller asset managers that do not have neither people of colour or women in their businesses.

How are managers dealing with the challenges?

There are managers who have business initiatives/plans to address transformation as an issue and others that have none. However, we realised that there seem to be a move towards improving internal hiring policies by focusing on EE candidates as first choice of employment. Commendable are those managers who have internship and graduate programs that focus on growing their own timber. This focuses on candidates of colour to address the race and gender challenges in our industry.

Small managers stated that it is also difficult to retain this talent given their demand in the market, and that large managers have a bigger budget to compete for this talent. This supports our thinking that, given their resources, larger managers should have transformed teams.

Conclusion

Transformation has come a long way, with previously disadvantaged people given opportunities to own equity stakes or participate in asset management businesses. However, transformation is not only about the level of black ownership or management control in the business. It is also about the individuals within the organisation representing diversity of race and gender. Some of the reasons cited for not achieving diversity include low team turnover – implying a lack of opportunities to hire new individuals – a shortage of senior female professionals and lower budgets to compete for talent. Although there are managers who have their own programmes to grow the pool of talent in the industry, there seems to be slow growth of the pool of females and individuals of colour in the roles that matter. If this challenge is not addressed now and sufficient programmes are not put in place, this imbalance will perpetuate for a long time.