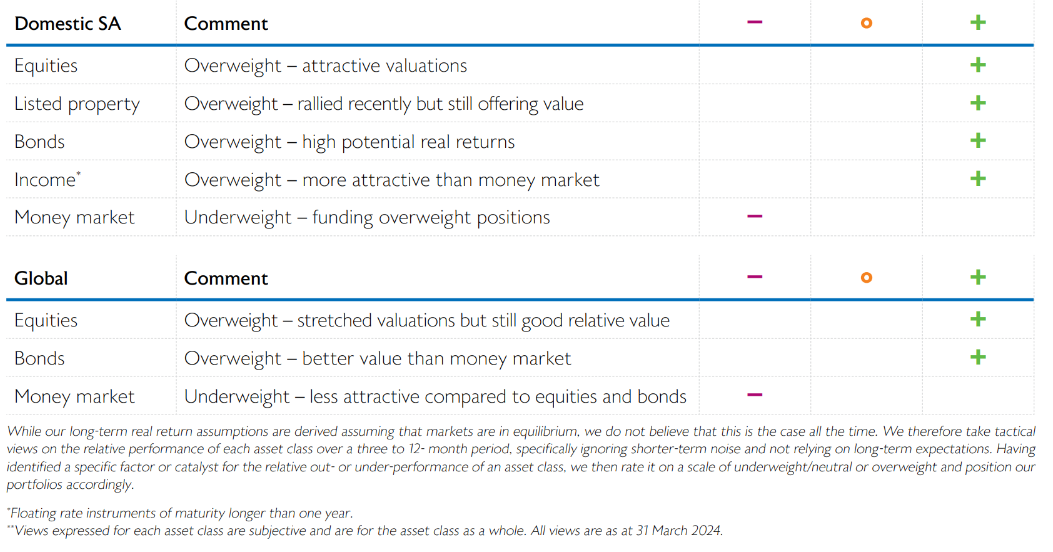

At a glance – our asset class views

Viewpoints Autumn Edition – April 2024

Domestic asset classes

Equities

- The FTSE/JSE Capped SWIX Index retreated 2.3% in Q1 2024. We increased our overweight position during the January sell-off and maintained our overweight throughout the quarter. The market is trading on an attractive forward PE of 13.2x and is offering a 4.3% dividend yield. We are of the view that current prices reflect most of the SA idiosyncratic risks – loadshedding, elections, SOEs, etc. – and small improvements in sentiment can lead to a quick re-rating as was the case in March.

Listed property

- The locally listed property market enjoyed further gains in Q1 (up 3.5%) and is up more than 20% over the past 12 months.

- Despite the recent rally, listed property is still flat over the past five years carrying the scars of the collapse of the Resilient group of companies in 2018. Recently, the 8.5% income yield; reduced loadshedding; stronger balance sheets and expectations of interest rate cuts have given the market better prospects and thus, we remain overweight.

Bonds

- The FTSE/JSE All Bond Index came under severe pressure in Q1, losing 1.8% as global markets readjusted their interest rate expectations back to an environment of ‘higher-for-longer’. The 5.6% inflation print in February was up from 5.1% and together with jitters on the likely outcome of the May elections, kept bond yields high.

- We have been overweight domestic bonds for some time now. The position worked very well for us last year but has come under pressure this year. The SA 10-year government bond is yielding 12.3% and in our view is reflecting most of the fiscal, social, and economic growth challenges that South Africa faces.

Income

- Income, like bonds, also struggled in Q1. It returned 0.8%, underperforming the 2.0% return from money market. The R186, a bond that matures in December 2026, saw its yield jump from 8.7% to 9.3% during the quarter.

- The income spread to cash reduced from 182 basis points in Q3 2023 to 31 basis points by year end – lower than the historic spread of 48 basis points. It is currently at 100 basis points, offering better value by historic standards. We continue to prefer income to cash.

Money market

- Currently, we prefer other domestic assets compared to cash and hence, we remain underweight cash.

Global asset classes

Equities

- The MSCI All Country World Index produced strong returns in Q4 2023 when investors expected the US Federal Reserve to cut interest rates six times in 2024, starting as early as March. In Q1, investors toned down their expectations, but equity markets soldiered on, rallying 8.3% in US dollar terms as the market turned its attention to the resilient US labor market and strong economic growth.

- We kept our marginal overweight position in Q1 while we weigh the effects of the ‘higher-for-longer’ environment against the 9% to 12% earnings expectations for 2024. The market is on a forward PE of 18.4x which is not ‘screaming cheap’ but prospects for technology companies remain good despite their 2023 rally.

Bonds

- The Barclays Global Multiverse Bond Index fell 1.9% in US dollar terms as inflation in the US remained sticky. It was 3.5% in March, higher than the 3.2% reported in February. The escalation in geopolitics and pushing out of interest rate cut expectations also weighed on yields.

- US 10-year treasury yields rose to 4.25% by quarter end. While interest rate cuts have been pushed out and inflation is somewhat sticky, short-term rates are expected to be lower by year end and we think locking in the current yields is a prudent decision – hence we remain overweight.

Money market

- Yields on money market instruments are higher when compared to bonds but we are of the view that this is likely to reverse later in the year when central banks start cutting interest rates. We thus prefer bonds and equities.