The Gender Agenda in South African Asset Management

“Women belong in all places where decisions are being made. It should not be that women are the exception.” – the late Ruth Bader Ginsberg, a trailblazer on gender equality since the early 1970s.

Women having the same rights in the workplace as men does not translate into gender equality when many women face unequal opportunities and biases that limit equal access to skills, development, growth and great career opportunities. This means that many industries are still generations away from reaching gender parity in their workforce.

According to the Citywire 2020 Alpha Female Report, it will take about 200 years for the global asset management industry to hit gender parity. The pace is glacial – in the four years since 2016, female fund managers have gained only 70 basis points to represent 11% of the 16 000 fund managers on the Citywire database.

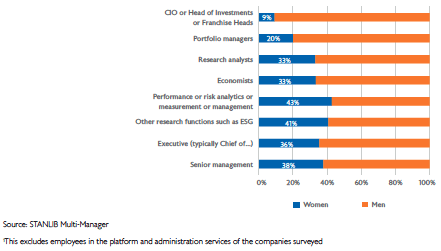

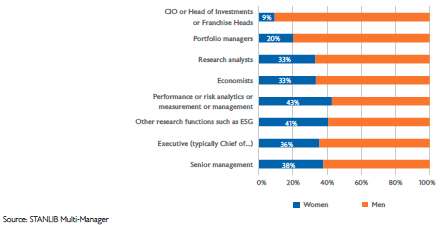

We surveyed 31 South African asset managers, representing a workforce of about 3900, to understand the level of gender diversity in the local asset management industry, from both an investment team and business perspective. The graph that follows illustrates the share of women in each job category or role.

We looked deeper into the investment function to evaluate the influence that women have on investment decision-making. As a broad measure, men involved in investment decision-making – chief investment officers (CIOs) or equivalents, research analysts and portfolio managers – outnumber women three to one. Specifically, the proportion of female CIOs is extremely low, at just 9%. While women make up 20% of the number of portfolio managers, beating Citywire’s global average of 11%, the level is still low.

Gender representation across various roles

The data suggest that women make up almost one-third of research analysts and 43% of investment support functions – much higher than CIO or portfolio management roles. This can be viewed from different perspectives. On the positive side, this could show there are budding female portfolio managers and CIOs further down the line. However, these metrics also provide tangible evidence of the infamous glass ceiling that many women face. Often this is chalked up to women stepping away from their careers to nurture their families. In addition, women face many other challenges, such as a lack of mentoring or championing, and inadequate networks or high-profile opportunities.

Roles within the investment function

Gender parity seems a much more attainable goal for senior management and executive positions within asset managers. However, female ownership was surprising low at 8% on average; and there was little difference between small managers – defined as having fewer than 50 staff – and large managers. We believe that driving this level of women ownership up is likely to drive a culture change and has the potential to drive female hires across businesses, including within the investment teams.

As part of our due diligence process, we delve into the diversity of investment teams to gauge the diversity of views, which could encourage robust debate. We believe this diversity is a strength in investment decision making. When questioned on a lack of diversity in teams and at a senior investment professional level, managers often say that they have a culture of meritocracy. We agree that meritocracy enables a high-performance culture, but managers should reflect on this from various angles and consider whether meritocracy is concealing conscious or unconscious bias.

We have seen several examples of this, where male founders or key portfolios managers hire young males. The lack of diversity is compounded because young male portfolio managers are often groomed to think like their seniors. We have also seen male portfolio managers encouraged earlier on to interact with clients, allowing them to build on their credibility and reputation. Female portfolio managers and research analysts should be given the same vote of confidence.

Meritocracy can only truly be applied fairly to men and women when there is gender parity. When male investment decision-makers outnumber females three to one, it means that asset managers are more likely to find top-performing young men than women to promote. Companies that achieve gender parity can deliver meritocracy without bias and run their investment teams on an equal opportunity basis. As an aside, this perspective also applies to driving up the number of black professionals within investment teams.

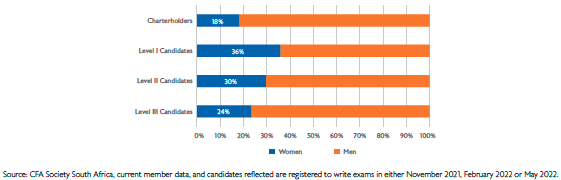

Managers also mention the lack of a diverse talent pool, which makes it difficult to hire and retain female investment professionals. The trickle feed of female talent into the investment industry over the past 20 to 30 years has created a small talent pool. We see evidence of this in the low proportion of female CFA charterholders and candidates – individuals registered to write a CFA exam – depicted in the graph below. Only 18% of charterholders are female and notably, the representation of female candidates decreases between Level I and Level III.

Asset managers need to promote and encourage higher levels of investment qualifications, among both their current female staff or potentially new staff, through graduate programmes that deliberately target females. This approach could even be used at a grassroots level, where companies encourage female high school students to study finance-related subjects that set them up for a career in investments. As our survey indicates, there is a larger, but not equal, proportion of women in research support functions. Managers could be more proactive in developing female investment talent from this pool and implementing career development plans that set females on the path to be investment decision-makers.

The crux of our research is that the level of women influencing investment decision-making is too low. Future surveys will allow us to evaluate the pace of gender change for these roles, among others. This has the potential, not only to change the culture of asset management, but also the culture of companies and industries that investment professionals analyse.

Driving the gender agenda in asset management is the responsibility of every individual asset management firm. Gender focused interventions and strategies need to be implemented in order to achieve meaningful change and gender parity for the next generation.