How should investors choose passive funds?

Richo Venter,

Head of Research and Development,

STANLIB Multi-Manager

Active investing relies on a portfolio manager making share selections based on his or her view on which shares will out-perform in future. Passive investing is generally sold to investors as a cost efficient method to gain exposure to the market or sub sectors of the market, with no stock selection. “Smart Beta” (or factor) investing has been around for many years, but has recently gained more publicity. The debate about whether one should invest passively, actively or using Smart Beta is an on-going debate.

Picking active managers that will perform in the long run is not an easy task and requires specialised research and analysis. Similarly, certain Smart Beta products have outperformed or underperformed during different periods historically, while certain factors have been shown to outperform over the very long-term. Although we highlight some of the difficulties when investing in passive or Smart Beta products, we think there is a place in the market for all three approaches.

Passive investing – selecting an appropriate index and provider

There are various decisions an investor needs to make when investing in passives. Determining the best or most appropriate passive index for a particular investor looking into the future is extremely difficult.

As an example, over the past few years the JSE FTSE Shareholder Weighted All Share Index (SWIX) was the best performing broad based JSE index. With hindsight, tracking this index sounds very promising, but in reality it would not have been such an easy decision 10 years ago. At that point the majority of market participants benchmarked their investment returns relative to the JSE FTSE All Share Index (ALSI), which has subsequently underperformed the SWIX.

When investing in an index tracking portfolio or investment, various decisions need to be made:

Which index to track – There are multiple indices to choose from in South Africa. Some of the broader indices include the well-known ALSI, the SWIX, MSCI SA Index as well as the S&P SA Index

Full index or large caps only – Both the ALSI and the SWIX have top 40 sub-indices, focusing on the largest 40 shares in the index. Selecting top 40 indices would give an investor exposure to the 40 biggest companies on the securities exchange. These blue chip companies are often thought of as stable. Small and mid-cap shares are typically more exposed to the local economy, while the top 40 shares are more exposed to the global macro environment. By choosing to invest in a passive product tracking any one of these indices, very specific biases are selected. When the SWIX is selected as a passive portfolio, an investor invests into a rand hedge industrial shares bias as well as a large single exposure to Naspers (which had an exposure of over 17% in the SWIX at the end of May 2016). This has been a winning formula in recent years, but could turn around in future. By investing in the ALSI, a higher resources positioning (resources are usually fairly volatile) is taken relative to the SWIX – quite an important decision that will affect the performance of an investment.

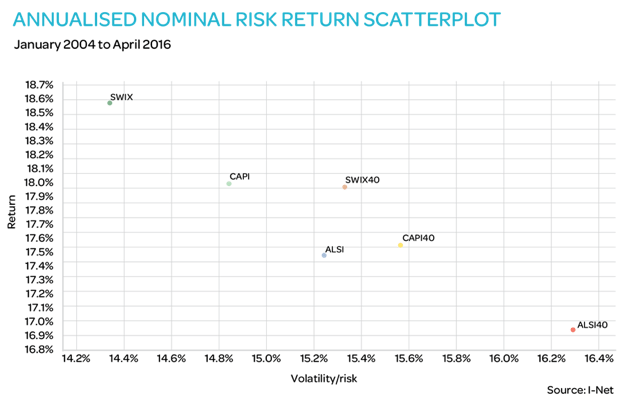

When looking at the risk and return graph below, it is evident that these large cap biases have come at higher risk in the longer term (since 2004), due to the lower diversification.

Capped or uncapped indices – Capped indices are also available on the ALSI and the SWIX, increasing the options even further. In South Africa, capped indices typically cap exposure to a specific share at 10%. Given the high exposure to a share like Naspers in South African indices, certain asset managers, including STANLIB Multi-Manager, have started promoting the idea of benchmarking performance relative to a capped shareholder weighted index. The S&P provides such an index, called the S&P DSW. A capped index isn’t a bad idea when trying to restrict large weights to single shares and improve diversification, but could underperform during periods when the largest shares perform exceptionally well.

Index provider – The FTSE JSE, MSCI and S&P are all index providers in the South African market. Different methodologies are used, which could result in different return profiles between these indices.

Once an investor has decided which passive index to track, the next step is to pick an index tracker provider. The index providers we previously mentioned construct the index, while the index tracker provider is usually an asset manager or bank that creates products to track indices.

These products could be unit trusts, segregated accounts, exchange traded funds, policies of insurance or other creative solutions they develop. Although we will not cover these options in detail, it is important to note that all these options come at a cost, meaning an investment will underperform the index by the fee charged by the product provider as well as other costs associated with running the product, like trading cost. This cost, which can be significant, is often overlooked by investors when comparing returns of active managers to indices.

Smart Beta – selecting appropriate factors

As Joao explained in his article and as elaborated above, passive investing is an active decision and investors need to make many active decisions. Smart Beta or factor investing, increases the onus to make the correct decisions. Smart Beta product providers provide increasingly more choices for factor returns, like value, momentum, quality and many others, and this means that the decision making process becomes exponentially more difficult as the factors expand. The reason why the impact is also much bigger, is due to the fact that factors typically have large return dispersions relative to each other and passive alternatives.

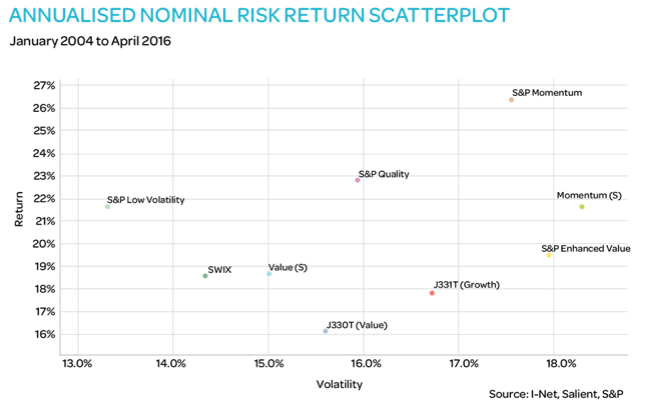

For illustration purposes we compared various factor based indices and products below. From the S&P we included a low volatility index, a momentum index (which includes a low volatility component in their offering), a quality index as well as a value index. We also included the FTSE JSE value and growth indices as well as two factor-based strategies from Salient Quants (Value(S) and Momentum(S)).

While certain factors like momentum have outperformed the ALSI in the last couple of years, the old favourite value factors had a difficult time both locally and globally. As various researchers have shown over the years, the value factor can take a very long time to realise – very few investors can stomach 10 plus years of under-performance. Nobel Laureate and joint father of the three factor model, Eugene Fama, has said publicly on numerous occasions that it could take over 30 years for the “value” premium to outperform. Hardly something that should be relied upon heavily or in isolation when designing a portfolio to outperform over shorter periods.

So why not just invest in the recent winner, momentum?

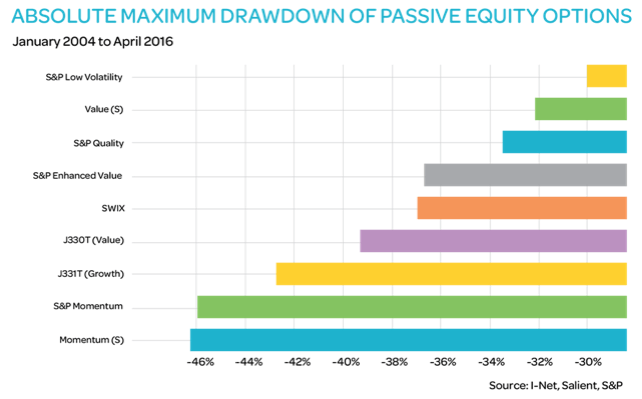

The answer is simple, momentum does not always out-perform. During the 2008 global financial crisis, a typical momentum strategy would have lost approximately 46% of its value, while the SWIX lost 37%. During this period the low volatility factor followed by the value factor was the most defensive. The maximum drawdown chart below illustrated the worst drawdown for each of these factors since 2004.

As illustrated in the annualised nominal risk and return scatter plot, the low volatility and quality factors look very appealing over the time longer-term period under review, but there is no guarantee that these factors will continue to outperform over the next five, 10 or 15 years. Many active asset managers are of the opinion that shares in these indices are highly overvalued.

Once an investor has decided on a factor to gain exposure to, it is still very tricky to decide on the definition of the factor. There are sometimes as many definitions of factors as there are managers and index providers using them.

As an example, the well-known value factor can be constructed in many different ways. You can invest based on low price-to-book ratios (originally defined by Fama and French in their seminal 1992 paper), low price-to-earnings ratios, low price-to-cash-flow ratios and many more.

Various combinations of factors are also offered by asset managers, typically as a response to the low predictive power of single ratio definitions. Some managers also try to time which factors will outperform in various periods, often with limited success. There are many construction methodologies applied around the globe and in South Africa and all of these decisions will result in differences in performance.

An investor needs to decide which methodology he wants to invest in, hardly a passive decision, and sometimes a more active decision than giving your money to a good equity manager and letting them make their choices.

Similar to passive investing, an investor will incur various costs when buying Smart Beta products. These costs include transaction fees as well as asset management fees. Smart Beta products may have much higher turnover compared to both passive and the average active equity fund, resulting in higher transaction fees, which can impact returns significantly.

Conclusion

In conclusion, various decisions are required by an investor when investing in either passive or Smart Beta products. The wrong decision could result in an investor not meeting his investment objectives or expectations. Investing in unintended bets can also be the trap of these strategies, as we illustrated with the 17% exposure to Naspers in the SWIX. Although Naspers is a well-diversified global company, few investors have the risk appetite to invest such a large percentage in one share. The return dispersion between Smart Beta products is even bigger and certain factors have shown to have much larger drawdown than a broad equity index, which might not be suitable for all investors.

We reject the traditional approaches of believing that one approach is better than another, and take the challenge of doing the hard work of researching all available options, head on.