Passives and Smart Beta widens our opportunity set

Jennifer Henry

Portfolio Manager,

STANLIB Multi-Manager

We are also in the differentiated position of being able to consider traditional assets such as equities, bonds and property, alternative assets or a variation on traditional assets such as the range of passive products from index replication through to factor or Smart Beta investing. Unlike a pure active single fund manager that is restricted to the traditional asset classes, a multi-manager can combine passive and Smart Beta with active managers provided that the client’s mandate allows it and there is a good rationale for blending these products with active managers.

How we think about active and passive opportunities

It is important to note that we assess the attractiveness of a manager or the construction of our portfolios from a variety of perspectives. For example, in constructing an equity fund, we assess an active manager’s ability and flexibility to source as many alpha opportunities as possible, particularly given that the South African listed equities market is relatively small.

This viewpoint came very much to the fore, after we completed an extensive round of due-diligences on the viable equity manager universe about two years ago and when we completed the same rigorous research two months ago.

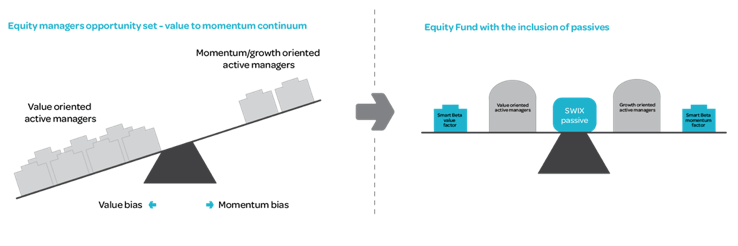

We identified a perspective, which we call the ‘value-to-momentum’ continuum, and when we assessed managers according to this, we found that many active managers typically had a ‘valuation’ bias to their portfolios.

What this simply means is that most South African managers would buy a stock if it looked cheap relative to an in-house intrinsic or fundamental valuation, coupled with a margin of safety to account for uncertainty in the valuation.

It is important to state that we don’t box managers into this continuum, or expect them to stay at the same point in the continuum over time. Instead, we seek managers that explore every opportunity within our market, in an attempt to add value to their clients’ invested money.

We highlight that managers with a larger value-bias in their investment philosophy have avoided high quality stocks, because they typically trade at expensive multiples. These value-oriented managers have also sold out of winning stocks early and therefore have not benefitted from the price momentum that quality stocks have enjoyed. Another factor impacting on active managers is the composition of the SWIX index, which has a rather hefty weight to Naspers (ranged from 12% to 17% over the past year). Our buy-rated active managers have a strong risk consciousness and are reluctant to hold this stock at benchmark weight or overweight in their portfolios, given the absolute risk in the stock.

Therefore as a result of valuation bias coupled with issues around the SWIX benchmark, active managers on average delivered returns 4.6% and 1.6% behind the SWIX benchmark in 2014 and 2015 respectively.

Practical passive examples and learnings from implementation

To compensate for this value bias, we implemented a SWIX passive mandate in the STANLIB Multi-Manager Equity Fund to capture some of the momentum left on the table by active managers. Prior to implementing these passives, the STANLIB Multi-Manager Equity Fund had exposure to two Smart Beta products, which were implemented in March 2013, to get exposure to “value” and “momentum” risk premiums. Given the high tracking error of these strategies, they were implemented in much smaller weights in the Equity Fund.

We highlight for investors that the inclusion of passives with these smaller Smart Beta wings, blended with core-like and flexible active managers allowed us to create more balance in our Equity Fund. Overall the key learnings on the use of passive strategies have been:

Irrespective of the type of opportunity investors are considering, apply a consistent process in understanding the return and risk of those opportunities.

Passive investing may have inherent risks, and Smart Beta in particular could have high tracking errors, which needs to be considered carefully for benchmark cognisant investors i.e. those investors not able to tolerate massive underperformance of the benchmark.

Inclusion of passive mandates needs to have a sound basis for implementing within a portfolio, with a good understanding of the potential outcomes of the overall portfolio.

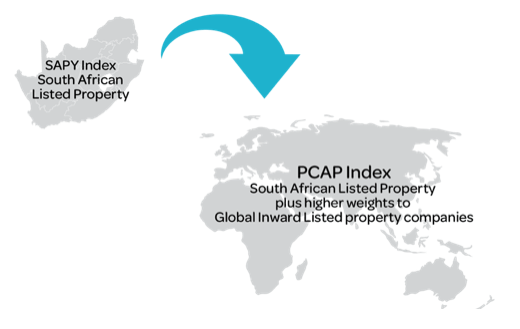

Another example of the implementation of passives within STANLIB Multi-Manager products is the inclusion of both the South African Property Index (SAPY) and Capped Property Index (PCAP) passives at different times, in our Property (domestic only) fund.

During an analysis of the property environment, we felt that active property managers had had a particularly good run versus the SAPY and that the alpha driven by capturing acquisition mispricing would have been limited. Therefore, we raised the South African Property (SAPY) passive exposure within the STANLIB Multi-Manager Property Fund.

The nature of the industry started to change as many inward listed property companies presented attractive fundamentals. These inward listed property companies usually own assets (shopping malls, offices etc) in countries such as Eastern Europe and the UK, that delivered good offshore earnings growth, and looked even more attractive as the rand weakened.

We also found that these companies were better represented in the Capped Property Index (PCAP) and we switched from the SAPY passive to the PCAP passive. We believe that the implementation of passives in the Property Fund and thinking behind which benchmark to use driven by fundamental factors, well illustrates that passive in itself is an active decision.

In conclusion

Passive and factor investing has been around for a number of years and at STANLIB Multi-Manager we have been an early adopter of these strategies and continue to use these additional opportunities to build the best possible outcome for investors.

While we highlighted learnings or outcomes from the implementation of passive investing, we stress that the full opportunity set needs to be reassessed continuously. For example, in a round of equity manager due-diligences in April 2016, we have found that more active managers are thinking about the quality angle of companies, which could imply less return from the momentum or quality factor in future years. This then requires a reassessment of our funds, in which passive mandates could play a role.