Future Focus December 2023

- Talking point: Consistency…the unsung hero of investment management.

- Investment centre: Using AI to help in determining if past performance is a predictor of future success.

- Manager insights: Movers and shakers – 2023 under review.

- Practice notes: Tax-Free Savings Accounts – be a smart investor.

We hope you find relevant insights in this Edition.

STANLIB Multi-Manager Investment Team

Talking point

Consistency…the unsung hero of investment management

Key points

Consistency rewarded – we won the DFM award for the year.

Demonstrating consistency helps investors to develop investment discipline and builds trust.

Several tips can nurture consistency in your investor journey, including using a reputable DFM.

Behind the award

Last year we won the Citywire 2023 DFM of the Year Award. This was a wonderful achievement celebrating our overall DFM proposition but also the excellent investment performance of our solutions. The big surprise about the award was there were 11 categories – four for service and seven for performance – and we only won one of those categories – best performance in the ASISA Medium Equity Category. So how did we win the DFM of the year? Well, the answer is quite simple, it was consistency.

We were the only DFM to be nominated in every single category – and a little birdie mentioned that we came second in every other category. As a result, our overall score was superior to that of any other DFM that partook because of our consistency. We are very pleased with the award and once again realised how important consistency is across a complete DFM offering.

The glue that holds your portfolio together

Imagine your investment portfolio as a delicious pizza. You have a crust (which is your long-term goals), your sauce (your asset allocation), and a variety of toppings (the underlying asset managers). Now, imagine trying to make this pizza while constantly changing the ingredients, the cooking temperature, and even the recipe itself. You would probably end up with something resembling a culinary disaster.

That is precisely why consistency is the unsung hero of investment management. It is the glue that holds the portfolio together, the steady hand that guides you through market ups and the market downs, and it is the secret ingredient to long-term success.

Think about it this way, would you trust a pilot who changes their flight plan every time the wind changed direction slightly? Of course not! You want someone who is methodical, disciplined, and sticks to the course. Investing is no different.

The secret ‘sauce’ of successful investing

“Consistency is the true foundation of trust”

– Roy T. Bennett

1. It reduces emotional investing

Markets are fickle beasts, prone to sudden bursts of enthusiasm and moments of utter despair. If you reacted to every headline and market blip, you would end up making impulsive decisions that could hurt your portfolio in the long run. Consistency helps you stay calm and rational, allowing you to ride out the inevitable storms and remain focused on your long-term goals.

2. It develops discipline

Investing is not a get-rich-quick scheme. It is a marathon, not a sprint. Consistency helps you to develop the discipline needed to stick to your investment plan, even when it is tempting to stray. This means saving regularly, rebalancing your portfolio as needed, and avoiding emotional decisions that could derail your progress.

3. It allows for compounding

The power of compounding is like a magic trick – start small, reinvest your returns, and watch your money grow exponentially over time. But this magic only works if you are consistent. Imagine planting a seed and then digging it up every few days to check if it is growing. Not very productive, is it? Consistency in investing allows the seeds of your wealth to flourish, reaping the benefits of compounding over the long run.

4. It simplifies decision-making

Having a consistent investment strategy means you do not have to constantly analyse every new investment opportunity. You have already established your criteria, your risk tolerance, and your long-term goals. This makes it easier to quickly evaluate potential investments and make informed decisions that align with your overall plan.

5. It builds trust

Whether you are working with a DFM or not, consistency builds trust. It shows commitment to your goals and willingness to make informed decisions. This can be particularly important when facing market volatility or making crucial investment choices.

Consistency does not mean rigidity

As your client’s life circumstances and goals change, you may need to adjust their investment strategy accordingly. But even then, making thoughtful, deliberate changes based on careful analysis is crucial.

So, how can you cultivate consistency in your client’s investment journey? Here are a few tips:

- Develop a clear investment plan. Define their goals, risk tolerance, and investment time horizon. This will serve as your roadmap for navigating the markets.

- Set up automatic contributions if they can afford to. This will help you save and invest consistently, even when they are busy.

- Review portfolios regularly. Rebalancing your portfolio as needed ensures it remains aligned with your goals and risk tolerance.

- Seek professional advice. Each of the steps above can be made a lot easier if you select a DFM that can take care of the investment management on behalf of you and your client and can provide personalised guidance and support.

Remember, consistency is not about being perfect. It is about making a conscious effort to follow your investment plan and avoid impulsive decisions. Even small steps taken consistently can lead to significant results over time.

Hence, stay the course, stay disciplined and watch your client’s wealth grow over the years.

Leigh Kohler

STANLIB Multi-Manager

Investment centre

Using AI to help in determining if past performance is a predictor of future success

Key points

A three-year track record, investing equally in the top quartile funds is no guarantee of similar success over the next three years.

Linear regression analysis indicates performance over the past three years is no indication of performance over the next 3 years.

A combination of in-depth qualitative and quantitative analysis is a better strategy to build outperforming solutions.

How much to draw?

Investors often study historical fund performance relative to industry peers when selecting an investment fund/portfolio, and from experience, a 3-year performance number is a popular reference point.

But how useful can short-term performance really be? Or is this a flawed approach?

In this article, using past performance, we analysed the ASISA Multi-Asset High Equity category. This category is the least restrictive among the Regulation 28 compliant categories, allowing asset managers ample scope to demonstrate multi-asset class skill. The category also contains well-known balanced funds managed by Allan Gray, Coronation and Ninety One.

We extracted four sets of three-year non-overlapping (this is very important) annualised returns from July 2011 to June 2014 (period 1), July 2014 to June 2017 (period 2), July 2017 to June 2020 (period 3), and July 2020 to June 2023 (period 4). For a fair comparison, only retail fee classes that had returns over a full period, were included. We tested how funds with three-year returns, in any two consecutive periods, performed from one period to the next. To speed up the exercise, we employed the help of artificial intelligence, using ChatGPT Plus and its Code Interpreter. We provided ChatGPT with all the fund returns and through multiple prompts, generated the analysis.

The process required trial and error, but we were highly impressed by the functionality.

The outcome of the analysis was separately verified.

Results: does top quartile performance persist?

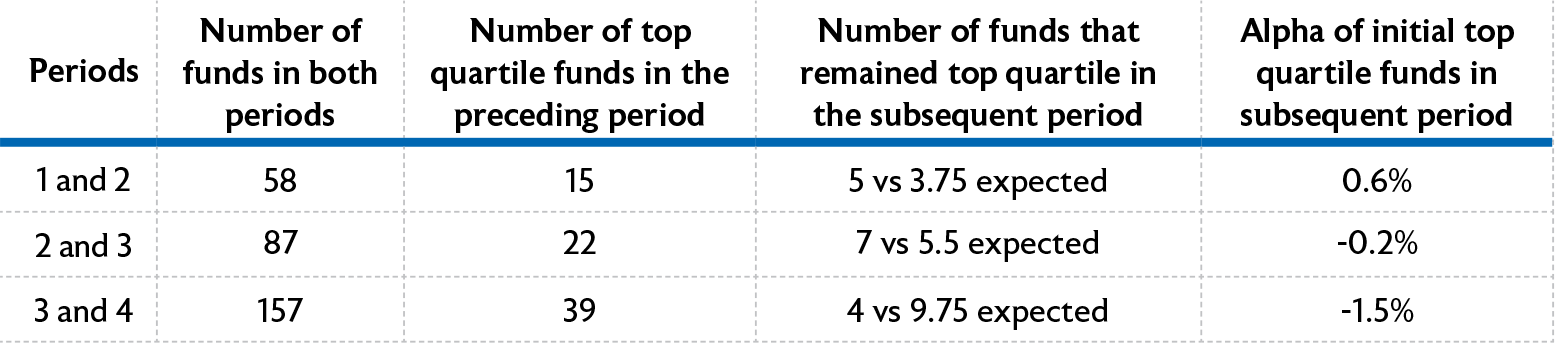

- Based on a small sample size of 15 top quartile performers in period 1, five funds remained in the top quartile over the next three years – slightly better than the four funds (25% of the 15 funds rounded up) expected if relative performance was random i.e., if funds had an equal chance of appearing in each of the four quartiles. These funds on average outperformed by 0.6% p.a. in the subsequent period.

- In period 2, of the 22 funds that were top quartile performers (note an increase in the number of funds as new funds were launched over time), seven funds remained in the top quartile in period 3, again slightly above what would have been expected if relative performance was random. However, on average these 22 funds underperformed the peer group average by 0.2% p.a. in the subsequent period.

- When testing period 3, the sample size of funds was 157 – almost double that of period 2. Amongst the 39 top quartile funds, only four of these funds remained top quartile over the next three years. This is significantly below the 10 funds expected if relative performance was random. On average these funds underperformed by 1.5% p.a. The table that follows summarises the findings.

Therefore, as illustrated in the table above, investing equally in the top quartile funds over the past three years is no guarantee of future outperformance, and could even lead to material underperformance.

Results: regression analysis insights

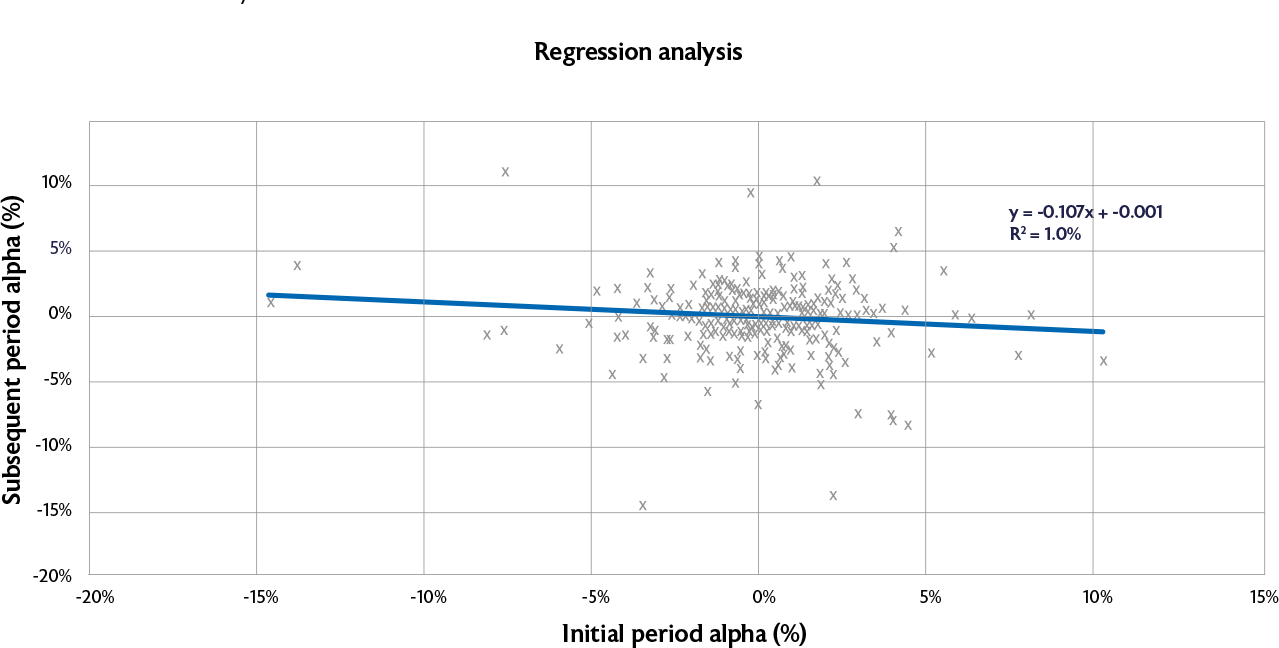

Using an alternative approach, we also asked ChatGPT Plus to perform a linear regression to establish if alpha over the initial three years (explanatory variable) had any predictive power of alpha over the subsequent three years. The advantage of this analysis is that it incorporates data from all the funds per period, not just top quartile funds, thus increasing the information available.

To further increase the power of the test, we combined the data from all the periods used for this exercise. Over the periods tested, the results suggest that past quartile performance and alpha, provide no insights into future quartile performance and alpha. It will also be interesting to expand the analysis to more ASISA Multi-Asset categories to determine if the results hold across multiple categories.

A strong indicator of this weak relationship is the regression’s low R-squared value of 1% (R-squared indicates how much of the variability of the data is explained by the regression). A result of 1% is very little, i.e., the model only explains 1% of the relationship between the x and y variables.

Furthermore, for the more numerical investor, in determining the significance of the regression, the p-value of the slope of the regression line is helpful. The p-value is the probability of observing these results under the null hypothesis that there is no linear relationship. It is approximately 8%, which is only slightly above the common significance threshold of 5%. This means that the relationship between the initial period alpha and subsequent period alpha is not statistically significant, at the 5% level of significance.

If, however, you wanted to conclude that there was a relationship at a slightly lower level of significance, it would in fact be that outperformance in one period, is more likely to lead to underperformance over the next period i.e., you should be buying the underperforming funds. We would caution against that relationship and rather conclude that there is no relationship between past and future relative performance – little variability is explained by the relationship i.e., statistical significance would not imply economic significance in this case.

How then to select a future outperforming fund

It was interesting to test how ChatGPT Plus can help improve analytics. We are increasingly testing such AI tools to see how they can aid analysis and decision making, and we can certainly see the use of this technology growing exponentially.

If ChatGPT tells us that fund alpha over the past three years provides limited insights into future alpha, how does one construct an outperforming solution for investors?

It is important to understand that a three-year track record provides limited insights, with an array of factors affecting outcomes, making the identification of asset manager skill very difficult. Therefore, our approach is a combination of in-depth qualitative and quantitative analysis with an operational due diligence overlay. Our quantitative analysis

is also not only performance-based but includes numerous performance and risk-based measures. Understanding performance in the context of a fund’s investment strategy, style, and positioning, is a key objective for us and our team spends thousands of hours on this each year.

Our approach is forward-looking – trying to understand the past to help us with future expectations. Similar to asset managers that diversify portfolios by including a number of shares, we diversify across multiple managers and strategies that we think have the potential to outperform in the years to come. Our process stacks the odds in our favour.

In our opinion, this forward-looking approach is a far superior approach compared to merely selecting from the latest performance ranking tables. This is evident in our consistent rankings in either the first or second quartiles over various time periods.

Richo Venter

STANLIB Multi-Manager: Joint Head of Portfolio Management

Manager insights

Movers and shakers – 2023 under review

Key points

Two stalwarts retire, leaving a legacy.

Coronation embattled in a court case over tax bill.

Changing the guard – several new captains to lead their respective teams.

Introduction

Annually, we provide you with major corporate activities and the movement of people in the local asset management industry – business happenings, shareholding structures and senior staff movements.

This also provides a platform to give recognition to some of the industry stalwarts that retired. Two respected individuals retired this year, Chris Freund from Ninety One and Henk Viljoen from STANLIB. We recognize that both won numerous awards over the years and devoted most of their professional career to helping clients achieve their financial goals.

Bok leadership lessons

The recent success of the Springbok rugby team – winning back-to-back world cups – offers valuable lessons for investment management businesses. Strong leadership, teamwork and collaboration, as well as diversity and inclusivity are key to success.

It is for this reason that our DFM research team continuously monitors business structures and team dynamics. We believe that diversity and team-based investment decision making contributes to successful investment outcomes.

It is never about the individual, it is about the team.

A summary follows of some of the important events we monitored throughout the year in our overall evaluation of the local asset management industry.

Main corporate happenings

2023 was a rather subdued year with regards corporate activity, especially in the context of the Sanlam Investment Management and Absa merger, which dominated corporate news in 2022.

Coronation received a red card from SARS

Following a court battle that arose from a South African Revenue Services (SARS) review of Coronation’s international operations for the 2012 to 2017 tax years, the Supreme Court of Appeal (SCA) ruled in favour of SARS in February. This saw Coronation face an additional tax bill of approximately R760 million. The SCA ruling reversed a Cape Town tax court’s decision that had been in Coronation’s favour.

Coronation has since applied to the Constitutional Court (ConCourt) to grant it leave to appeal the SCA ruling, which it also wants dismissed. They argue that the SCA erred in upholding the appeal in a legal document filed with the ConCourt.

In view of that, SARS responded to Coronation’s ConCourt leave to appeal. In a November practice note, SARS wrote that they believe Coronation’s net income from its Irish resident company is taxable in South Africa. SARS argues that Coronation Global Fund Managers (CGFM) does not meet the requirement of a ‘foreign business establishment’ (FBE) as such functions are not outsourced to a company in Ireland, where CGFM is located.

The outcome of the ConCourt case is likely to impact on multinationals with similar offshore structures. We have engaged with managers with similar offshore structures, and they are being proactive on auditing and reviewing the setup of their FBE’s.

During the year, Aluwani Capital Partners acquired 100% of Afena Capital. The Afena employees were all absorbed into Aluwani, including the six investment professionals.

We also saw a significant change in the shareholding within the Prescient Group. Prescient Holdings (Pty) Ltd provides solutions in asset management, investment administration and stockbroking. Staff in the business now own 25% of Prescient Holdings’ business, up from around 16%. In addition, another existing shareholder, Sithega, increased its economic interest in the business to 36%. This brings their total black ownership to approximately 69%. Both transactions were facilitated by Stellar Capital Partners, who sold their economic interest in the Prescient Empowerment Trust. We view the increase in staff ownership and the increase in black ownership as positive.

Local wealth and investment business, Anchor Capital founded 12 years ago, will become part of London based Credo in a R2.5 billion-merger transaction. The merger, which is subject to South African and UK regulatory approval, will create a combined entity with assets under management and advice of R230 billion ($12 billion). Anchor and Credo will each own 25% of the new company. Quasi-institutional shareholders will own the other half of the company.

Lastly, global financial services firm, Apex Group, acquired the Efficient Group. Efficient is the parent company of Boutique Collective Investments (BCI), a collective investments scheme manager for third-party branded portfolios, and Boutique Investment Partners (BIP), an independent investment management and consulting firm.

Senior management and CIO changes

New CIO for OMIG

Siboniso Nxumalo has been appointed as the new Chief Investment Officer for the Old Mutual Investment Group (OMIG). Siboniso became Head of MacroSolutions in January 2021 after the merger of the Old Mutual Equities and MacroSolutions businesses.

In addition, Old Mutual Wealth appointed Kieyam Gamieldien as the managing director of Old Mutual Multi-Managers. Gamieldien joined the multi-manager from OMIG, where he was the head of Customised Solutions.

Sanlam – several senior appointments

Nersan Naidoo, CEO of Sanlam Investments, resigned with his responsibilities taken over by the incumbent CEO of Sanlam Investment Group i.e., Carl Roothman. Sanlam Investments Multi-Manager (SIMM), appointed two deputy CIOs, Suvira Bodha, Head of Alternatives, and Mark Phillips, Portfolio Manager. Their appointments signify the organisation’s forward-thinking approach and dedication to business continuity.

New domestic CIO for Foord

Nick Balkin was promoted to Chief Investment Officer (South Africa) at Foord. Nick has been with Foord for 18 years. Dave Foord continues in the role of Global CIO.

New CIO model for M&G

David Knee, previously CIO of M&G Investments Southern Africa, has moved to the M&G UK investments business as the Co-Deputy Chief Investment Officer of Fixed Income. In his new role, he will continue to work closely with the South African Fixed Income team. M&G has implemented a new CIO model tailored to each investment capability, and has assigned a dedicated CIO for each area. Sandile Malinga, the current Co-Head of Multi Asset, will assume the role of CIO for Multi-Asset. Gareth Bern, the current Head of Fixed Income, and Ross Biggs, the current Head of Equities, will take on the roles of CIO for Fixed Income and for Equities, respectively.

CIOs swapping roles – PSG

Greg Hopkins, PSG Asset Management’s incumbent CIO, swapped roles with the deputy CIO, John Gilchrist, effective January 2024.

Replacement for Jeanette Marais

Momentum Metropolitan appointed Ferdi van Heerden as the CEO of Momentum Investments. He replaced Jeanette Marais, who took over as the group CEO. From an investment perspective, Mike Adsetts’ acting CIO role was made permanent in July 2023, replacing Sonja Saunderson who left at the end of 2022.

New roles at Alexforbes

Alexforbes Investments promoted Senzo Langa and Lebo Thubisi to newly established roles of Joint Deputy CIO, both reporting to CIO, Gyongyi King. Langa and Thubisi have spent more than 10 years within the investments business in senior roles. Langa will be heading up portfolio management and Thubisi, manager research.

First CEO for Cogence

Lastly, Jonel Matthee, who was head of Sanlam Multi-Manager International following the Absa merger, joined Cogence DFM as its first CEO, effective January 2024.

Jennifer Henry

STANLIB Multi-Manager: Deputy Chief Investment Officer

Practice notes

Tax-Free Savings Accounts – be a smart investor!

Key points

Discipline – contribute annually and enjoy a full year of tax-free growth.

Patience – the tax benefits compound exponentially if you invest for the long term.

Suitability – invest in growth portfolios to optimise your tax savings benefit.

Do not miss out

The introduction of Tax-Free Savings Accounts (TFSAs) in 2015 has been a very successful initiative from government to encourage savings in South Africa. Surprisingly, given the massive tax incentive to save, the uptake has been rather pedestrian. For example, only ¹half of active TFSA investors on the Ninety One IP platform made an investment into their TFSA in the last tax year, and only approximately 31% invested close to the maximum annual allowance.

Nonetheless, it’s never too late. If you have not contributed towards your TFSA this tax year, or maybe you are a first-time investor, you have until the end of February to make your contribution (up to R36 000) as part of your R500 000 lifetime contribution limit.

¹https://ninetyone.com/en/south-africa/insights/tax-free-savings/simple-mistakes-tfsa-investors-are-making.

Stay invested

As with all worthwhile things in life, patience and discipline are vital. Investors sometimes think because it’s an account, it must be held in the form of bank or fixed deposits. Not at all – the longer you remain invested, the greater the benefit from tax-free growth. You should have at least a 10-year investment horizon when choosing a tax-free savings account. It is important to consider growth investments, in other words investments such as shares and/ or listed property, or balanced portfolios.

You are welcome to withdraw funds from your TFSA at any time. However, if you choose to do so, your annual and lifetime allocations will remain unchanged, and you will not be able to top that up again. TFSAs are therefore not ideally suited for shortterm savings or emergency expenses as regular withdrawals will eat away at your lifetime allowance.

It is therefore clear – if you look at the rules of TFSAs – that investors are incentivised to stay invested and save towards long-term goals such as school education and/or retirement.

Optimise tax benefits

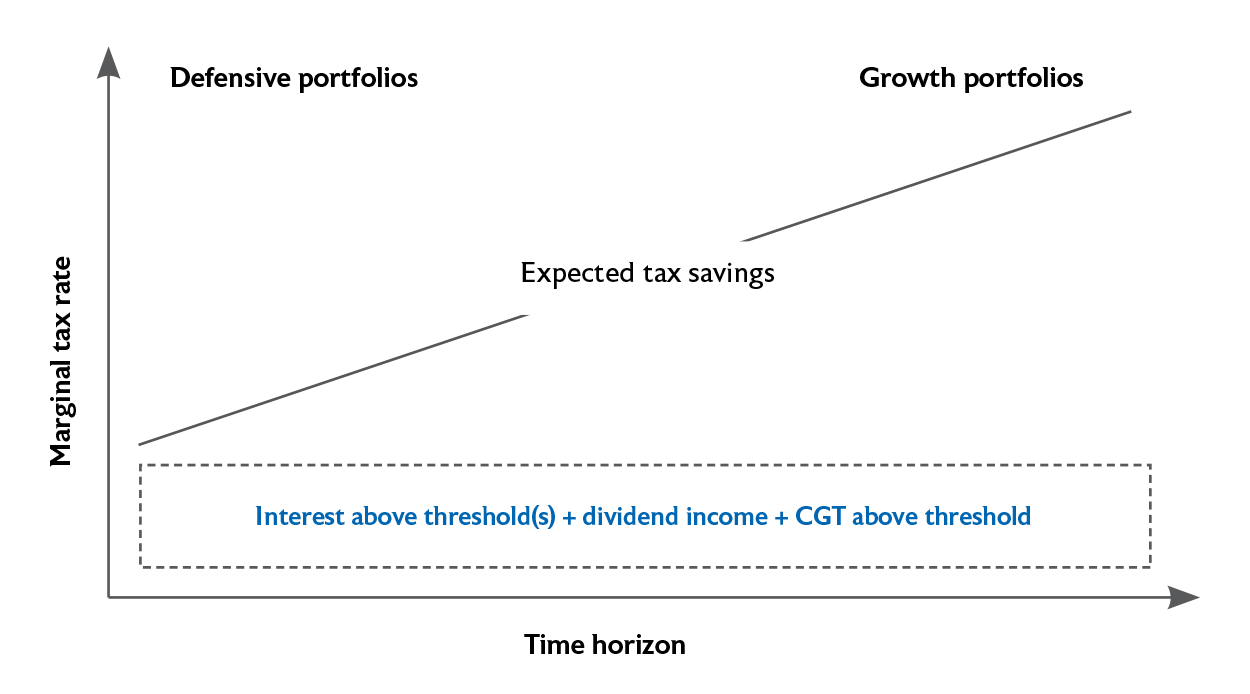

The extent of your tax saving will vary significantly across the universe of portfolios available. It depends on a combination of factors, the primary two being:

- Your marginal tax rate, and

- The type and amount of income and capital gains earned from your selected portfolio(s).

Growth portfolios typically have most of their assets invested in equities, including listed property. In a TFSA wrapper dividends received from shares, both locally and offshore, are exempt from paying 20% dividend withholding tax (DWT). Listed property dividends (‘distributions’) are also tax-free. The saving on DWT, and relatively high property distributions (‘dividends’) in growth portfolios make them ideal longterm investments for TFSAs as illustrated below.

The CGT saving is HUGE

We tend to forget quickly but it is important to remember that when you disinvest from your TFSA one day (after say 10 years) you will not be liable for any capital gains tax. Hence, do not underestimate the massive tax saving as demonstrated in the example that follows.

Example

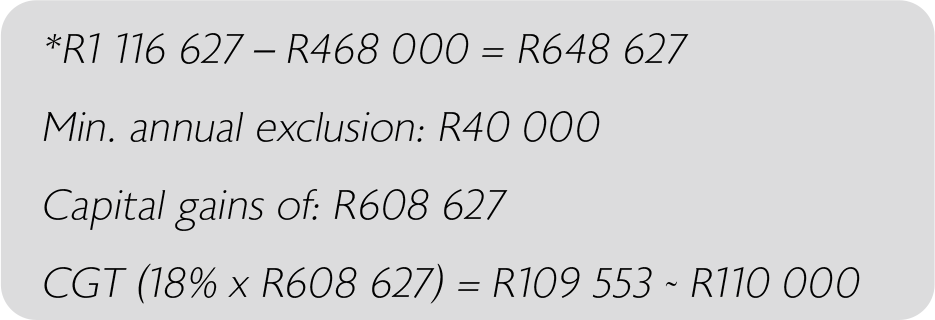

The investor realises the full extent of the cost of education once a child starts school. Hence, he/she decides to invest the full annual tax-free allowance of R36 000 every year for 13 years, which means that the investor would have contributed a total of R468 000 over the period – this is very near the current maximum R500 000 lifetime limit. If the annual R36 000 was invested in a high growth multi-asset portfolio and achieved a real return of inflation plus 6% over the 13 years, it would have grown to ²R1 116 627 when the investor decided to sell his investment to pay for the child’s education.

The capital gains tax saving of *R110 000 is substantial by comparison with a non-tax free investment portfolio. The investor would therefore have notched up an extra R110 000 for school education at the end of the 13-year investment term, solely because of the tax-free benefits. This would be a welcome bonus when saving for a specific goal such as education.

²Assume the portfolio achieved al return of 12% per annum (with inflation at 6%).

Do not misallocate your lifetime allowance

At present, investors benefit from an annual tax-free interest exemption (currently R23 800 per year for individuals under age 65). At current money market rates of between 7% and 8%, an investor in South Africa can keep up to ³R300 000 in a traditional fixed income account/fund before paying any tax on the interest. Investors should therefore be wise and not use their TFSA for their short-term financial goals or emergency cash pool. No need to waste your TFSA lifetime limit of R500 000 to meet your short-term goals – you already benefit from the annual tax-free interest exemption.

³R297 500 = 23 800/8%

Use it or lose it

TFSAs are a great solution to the poor culture of saving in South Africa. Despite the relatively poor uptake to date, investors should continue taking advantage of the tax-free benefits to grow their savings.

If used wisely, TFSAs can have significant and positive long-term financial consequences. The key is to be disciplined – start contributing as soon as possible and contribute the maximum allowed each year – or the amount you can afford. Patience – not making any withdrawals in the early years and lastly, selecting an appropriate portfolio – long term growth portfolios that will allow you to maximise the tax benefits – be a smart investor!