Please be aware that there are risks in simply implementing these views into a portfolio without carefully considering the dynamic nature of the environment, how changes impact each asset class and the unique needs of each client.

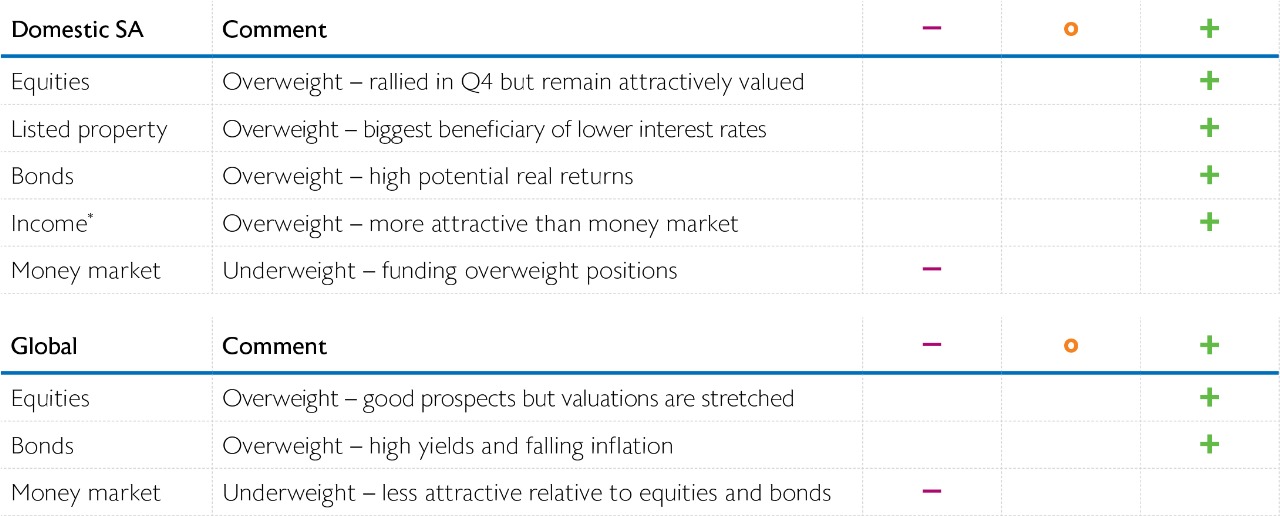

While our long-term real return assumptions are derived assuming that markets are in equilibrium, we do not believe that this is the case all the time. We therefore take views (tactically over/underweight) on relative asset class performance over three to 12 months, specifically ignoring shorter-term noise and not relying on long-term expectations i.e., we need to see the catalyst for the relative performance.

*Floating rate instruments of maturity longer than one year.

**Views expressed for each asset class are subjective and are for the asset class as a whole. All views are as at 31 December 2023.

Domestic asset classes

Equities

- The FTSE/JSE Capped SWIX Index finished the year on a strong note, rallying 8.2% in Q4 as market participants started pricing aggressive interest rate cuts by central banks in 2024.

- We were of the view that the market unfairly ‘punished’ local equities and our thesis was proven correct in November and December when central banks became more dovish. Despite the recent rally, equities remain attractive.

Listed property

- The Q4 rally turned the fortunes of this asset class – after down 5.4% for the first 9 months of the year, it finished up 10.7% for 2023.

- We remain overweight domestic property companies. Valuations remain attractive and fundamentals continue to improve. Property tends to lag most asset classes when interest rates are rising but when the tide turns, as is likely to be case this year, it performs well.

Bonds

- Domestic bonds with maturities greater than 12 years were trading at yields above 12% at the start of the quarter. For a country that has a successful track record of keeping inflation in check (within its 3% to 6% band) we thought these yields were unjustifiably high, even if one factored in the possibility of a fiscal slippage.

- On the back of this, we maintained an overweight position to bonds throughout 2023. We continue to like SA bonds as we think there is further room for yields to come down now that inflation seems to be on a downward trajectory.

Income

- Income returned 4.1% in the last quarter of 2023, comfortably beating SA cash.

- The spread to cash has reduced from 182 basis points at the start of the quarter, to 31 basis points in December. This is lower than the historic spread of 48 basis points. However, if one assumes that when global central banks start cutting rates the SARB is likely to follow suit, then the current spread is likely to increase when compared to cash. For this reason, we remain overweight income.

Money market

- The repo rate is currently 8.25% and SA 3-month JIBAR is at 8.4%, higher than the 6% we saw only a year ago. While this is positive, future short-term rates are likely to be lower as interest rate hikes are likely behind us. The market is pricing-in a short-term rate of 7.7% towards the end of the year.

- Given our expectation of interest rate cuts, we prefer other domestic asset classes compared to money market.

Global asset classes

Equities

- Global stocks had a good quarter, rallying 11.1% largely driven by developed market equities. In rand terms, returns were 3.0% lower as the rand firmed against the US dollar in Q4.

- We remain marginally overweight global equities despite stretched valuations, as global equities stand to benefit from lower interest rates in 2024. The MSCI AC World Index is on a forward PE of 18.5x and is becoming more expensive. The market is expecting earnings to grow by 10.7% this year, which may disappoint as global growth is likely to slow.

Bonds

- Bonds returned 8.1% in US dollar terms in the last quarter of 2023 as bond yields in many countries fell. Global inflation remains on a downward trajectory.

- The sell-off in yields in the past two years has made bonds attractive and we increased our overweight position after many years of being underweight. We think bonds will benefit from lower inflation and the subsequent cuts in interest rates.

Money market

- Yields on money market instruments are higher compared to bonds but we think this is likely to reverse soon when central banks start cutting interest rates, hence our preference for bonds and equities.