Fed begins pivot toward lowering rates

The strong rally across global and local assets in Q4 represented a welcome turn-around in investor fortunes for 2023, helping erase much of the losses of previous months.

The story of the year has been interest rates. At the start of 2023, most economists were convinced that a US recession was imminent. Economic and market forecasts were gloomy as the Federal Reserve (Fed) continued hiking interest rates to fight inflation, raising borrowing costs for already struggling businesses and consumers. But instead of struggling, global equity markets soared as the largest economy in the world, the US, remained robust. Rising interest rates have managed to slow inflation with a resilient labour market, leading to steady consumer spending and GDP growth.

At its December meeting, the Fed revealed that it expects inflation and interest rates to decline in 2024 and opened the door to interest rate cuts in 2024.

Timing and depth of interest rate cuts

A soft landing is a unicorn, but it is now more likely that the US economy will be able to move successfully into a soft landing with the focus shifting to WHEN and HOW many rate cuts to come. The market is already pencilling in three rate cuts for 2024. However, some analysts are concerned that the final leg of the Fed’s battle with inflation will be more difficult than expected and that a US recession could still happen.

“The consensus is we’re going to have rate cuts … in March. I think that’s maybe too optimistic.”

– Marko Kolanovic (Chief Market Strategist, JP Morgan)

Global equity markets up – AI mania ran away with the spotlight

Equity markets sold-off from late July through to October as fears built that the Fed’s campaign to fight inflation would leave interest rates higher for longer than investors wished for. BUT then the big surprise – shares around the world rose sharply in the last two months of 2023 as benchmark bond yields fell on expectations that the Fed can achieve a Goldilocks scenario of lower inflation without a recession.

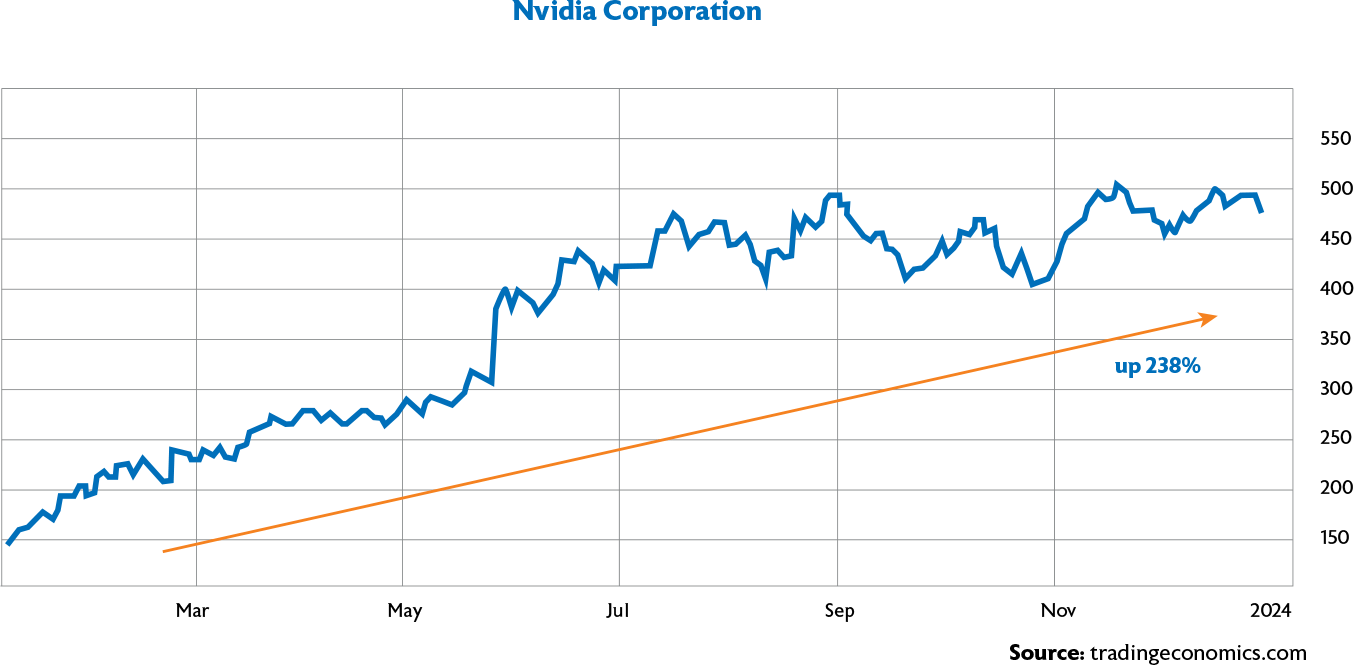

The MSCI AC World Index surged 11% in Q4, ending the year above 20%. Shares rallied across the board on Wall Street. The S&P 500 Index was up 24.7% and the Nasdaq 100 Index advanced a staggering 55%, led by the magnificent seven, which includes Apple (up 48%), Microsoft (up 57%), Alphabet (up 58%), Tesla (up 101%), Amazon up (81%), Meta (up 183%) and poster child, Nvidia (up 239%).

Semiconductor stocks were the main beneficiaries. Nvidia’s graphics processing units (GPUs) are likely to help the company further increase its market share. Companies such as Amazon, Microsoft and Alphabet are expanding their global operations, driving demand for Nvidia’s chips. By applying its GPUs in AI models, Nvidia is now also expanding its base in untapped markets such as automotive, healthcare, and manufacturing.

It is important for investors to bear in mind that while these big tech shares made money in 2023, most of the returns came from a re-rating. In other words, investors are paying more for the prospective expectations of returns rather than the actual earnings growth experienced.

– Clyde Rossouw (Ninety One)

Could investors just be paying up in optimism? At these high multiples, you had better be sure that the earnings growth is going to come through. Goldman Sachs Group analysts, who correctly predicted that the economy would not enter a recession in 2023, said they expect the S&P 500 to end 2024 at 5100, a 7% jump from its year-end level in 2023. But if investors have learned anything from 2023, it is the difficulty of making accurate predictions about the market’s next turn.

Japanese shares extended their bull streak in 2023 to highs not seen since 1990. The Nikkei gained 28% in 2023, making Japan the top-performing market in Asia.

Those gains came as solid corporate earnings and a strong rally in technology stocks – driven in large part by enthusiasm over artificial intelligence – lifted Japanese markets through most of the year. The refusal by the Bank of Japan to undo massive stimulus also pushed stocks higher.

China – property dilemma

During Q4 China ramped up more efforts to stimulate the world’s second largest economy, issuing additional sovereign bonds and raising its budget-deficit target. This is the first time it has revised its budget outside the regular legislative session in more than a decade. As a result, China’s official fiscal deficit will rise to 3.8% of GDP, up from the 3% ceiling set by the government in March, signaling clear concern about near-term growth. The latest stimulus follows a flurry of piecemeal measures such as interest-rate cuts and the lowering of mortgage costs for property buyers.

Chinese investors typically invest 70% of their wealth in property. The turmoil in the property sector – visible in acres of unfinished apartment blocks and troubled developers – weakened consumers’ appetite for spending, leaving the Chinese economy with huge challenges:

Consumer prices in China tumbled 0.5% in November compared to a year earlier; and steeper

than the 0.2% fall in October. This deflation reflects both weak consumer spending as well as

oversupply – factories reduced prices to unload high inventories.

Consumer prices in China tumbled 0.5% in November compared to a year earlier; and steeper

than the 0.2% fall in October. This deflation reflects both weak consumer spending as well as

oversupply – factories reduced prices to unload high inventories.  Last quarter, property developer, Country Garden Holdings, took steps to alleviate some concerns,

paying off a yuan bond of $111 million ahead of schedule to help restructure its offshore debt. The

authorities want to ensure distressed developers build the apartments that they have pre-sold to

mortgage payers. Astonishingly, China still has about 8 billion square metres under construction –

roughly 80 million typical three-bedroom homes.

Last quarter, property developer, Country Garden Holdings, took steps to alleviate some concerns,

paying off a yuan bond of $111 million ahead of schedule to help restructure its offshore debt. The

authorities want to ensure distressed developers build the apartments that they have pre-sold to

mortgage payers. Astonishingly, China still has about 8 billion square metres under construction –

roughly 80 million typical three-bedroom homes. The International Monetary Fund expects growth in China to slow to 4.6% in 2024, from 5.4% this year.

Stock market lagged

Chinese markets underperformed in 2023, despite optimism at the start of the year when Beijing ended its zero-Covid policy. The MSCI China Index lost almost 13% whist the CSI Index lost 11% due to a string of problems – the property crisis, debt overhang (China’s credit outlook was cut to negative by Moody’s), geopolitical tensions; and the risk of ongoing regulatory interventions, which drove away foreign participation.

Geopolitical risks are now a top consideration for buyers of Chinese securities and shareholding in private companies. For example, in November Alibaba shelved a plan to carve out its large cloud-computing division because US chip curbs could hamper the unit’s business activities. Alibaba lost about $20 billion in market value in a day, demonstrating how US-China tensions can cause unexpected losses for investors. Also, in December Chinese regulators released draft regulations proposing a set of measures to limit the amount of time and money players spend online. Tencent (-10%) and NetEase (-16%) dropped sharply on the day. Most of the losses were recouped in the days that followed, when the regulator said they may revise newly drafted online gaming rules – causing more volatility and uncertainty for investors.

The MSCI Emerging Markets Index delivered 8% despite being hamstrung by weak Chinese performance. The underperformance of the Chinese stock market last year has reduced China’s weight in the MSCI Emerging Markets Index to 26%, from more than 38% three years ago.

Bonds defied the odds

In one of the biggest surprises of all, higher bond yields did not turn out to be the boogeyman that many investors feared. A historic bond rout – which drove the 10-year US Treasury yield to 5% in October for the first time in 16 years – ended the year at 3.8%, while the 2-year Treasury notched its biggest yearly decline since 2020, settling at 4.2%. This reduced the inverted yield curve gap down to roughly 40 bps.

Behind the drop in yields has been a sustained decline in inflation around the world, which has driven expectations that central banks will cut interest rates in early 2024. The Bloomberg Global Aggregate Total Return Index rose nearly 10% over November and December, and 8% in Q4. Strong appetite for bonds is a sign that investors want to lock in attractive yields prior to expected Fed rate cuts. Investment-grade corporate bonds globally also rallied, returning almost 11% since the start of November. A tightening in spreads helped credit outperform government debt over that period.

Lastly, the oil price ended the year at $71.6 a barrel, down 11% for 2023 – mainly a result of the US deliberately increasing production.

Local market

Growth stalls

Growth in the SA economy decreased 0.2% in Q3. This figure represented the SA economy’s first drop in 2023, with gross domestic product (GDP) growth having been 0.4% in the first quarter and 0.5% in the second.

Consumption expenditure decreased by 0.3% in the third quarter. The main negative contributors were expenditure on transport, housing, water, electricity, gas and other fuels. Load shedding remained a bind on growth, as did Transnet’s enormous and worsening logistical problems – which also negatively affected state revenues and foreign investor sentiment. It now seems possible that the previous consensus GDP growth forecast of around 0.8% for 2023 may need to be revised downward, perhaps

to around 0.6%.

A lack of private fixed investment remains a matter of concern, as it is upon this that future growth and employment greatly depend. Although there is welcome evidence of increased private investment in alternative sources of energy, total fixed investment is only approximately 15% of GDP. We need fixed investments at roughly 30% of GDP if the economy is to reach much higher levels of economic activity i.e. growth and employment.

SARB leaves interest rates unchanged

At the SARB’s last meeting of 2023, they opted to keep the repo rate unchanged. This interest rate decision appears entirely appropriate given SA’s economic conditions, as well as international trends.

Since November 2021, the repo rate has increased by a total of 475bps, which is very significant, taking the repo rate to its highest level since April 2009, effectively the highest interest rates in 14 years. Interest rates are expected to remain unchanged during the first few months of 2024, with a cut in rates possible by mid 2024, especially if global interest rate pressures continue to dissipate within the US and other major developed economies. In November, the annual rate of inflation dropped to 5.5% from 5.9% in October. From an estimated average of 5.8% this year, inflation is expected to decline to 5% next year and 4.5% in 2025, according to the median forecasts of 19 economists polled by Reuters in December.

During the last three months of the year the rand appreciated around 3% against the dollar. This was mainly due to dollar weakness now that the US Fed may not need to raise rates further. At year end the rand was trading at R18.30 to the dollar, still a 7.5% depreciation for the full year.

Equity market up strongly

The JSE continues to suffer from an ongoing wave of delistings that saw 22 companies disappear from the bourse in 2023 thanks to red tape, high costs and the rise of private equity as an alternative means of raising capital for corporate expansion.

In addition, foreign investors have been forced to sell down their holdings in two more ‘SA Inc’ blue chips, following the announcement by index provider, MSCI, that another two companies would be removed from its South Africa Index in Q4. African Rainbow Minerals and Growthpoint followed the removal of MultiChoice, Mr Price, and TFG in Q3 after they were also ‘forced’ out of the MSCI Emerging Markets Index. This brings the total number of deletions of South African shares this year to five and illustrates the fading significance of the JSE globally.

Despite the above challenges, the JSE/All Share Index returned 6.9% in Q4 and was up 9.3% for 2023. This was driven largely by a dramatic shift in interest rate expectations following recent data showing inflation falling faster than expected in western economies. Financials (up 12.3%) were the standout performer, industrials added 6%, while resources closed the quarter marginally firmer, up 3%. Slowing momentum in China’s recovery continued to weigh on commodity markets, and Sasol has not had a particularly good run of late, with the share price falling 29% in Q4 – impacted by a combination of operational challenges and a volatile global economic landscape that included depressed chemicals prices. In addition, the palladium price dropped 12% in Q4 and close to 40% in 2023, as demand faltered amid a slowdown in vehicle sales, the rise of electric vehicles and users switching to ‘cheaper’ platinum.

The JSE/All Property Index gained 15.9% for the quarter as appetite for risk assets returned to the market, while the JSE/All Bond Index bounced back with an 8% return as global bond yields fell. Money market assets, as measured by the STeFI Composite

Index, delivered 2%.

In conclusion… year of elections

Globally, more voters than ever in history will head to the polls – 40 countries plus the European Union, which represents almost half of the world’s population.

Locally, the ANC faces the prospect of losing its overall majority, effectively forcing it to govern the country in a coalition with other parties. Whatever the outcome, be cautious when making investment decisions and remain focused on your goal(s).

Albert Louw

STANLIB Multi-Manager