STANLIB Multi-Manager Real Return Fund – new underlying manager

STANLIB Multi-Manager Real Return Fund – new underlying manager

As part of our continuous assessment of managers and the market, we have reviewed the portfolio construction framework of the STANLIB Multi-Manager Real Return Fund (the Fund). This Business Update details the changes that have been made to the underlying managers and weightings.

The objective of the STANLIB Multi-Manager Real Return Fund is to outperform the average return of its relevant peer group – the ASISA South African Multi-Asset Medium Equity category – at risk levels consistent with that of the category.

The Fund has a consistent long-term track record in achieving this objective and we expect it to deliver a real return of 5% p.a. over the long term, on a net of management fees basis. To minimise the risk of capital loss, an investment period of at least five years is recommended.

Inclusion of Truffle Domestic Multi-Asset Low Equity

We saw the opportunity to allocate a portion of the Fund to Truffle with the aim of improving diversification. STANLIB Multi-Manager has multiple mandates in place with Truffle and their introduction to the flagship STANLIB Multi-Manager Real Return Fund was a natural progression. In addition, Truffle’s inclusion creates consistency in our STANLIB Multi-Manager Balanced range of funds.

Truffle is a highly successful, well-resourced, boutique manager that we rate highly. They follow a bottom-up, valuation-based research approach across asset classes. Although a long-term strategic asset allocation framework guides their exposure to different asset classes, they remain highly flexible around this framework. Due to their consistent historical performance success, Truffle has grown its assets under management to approximately R71 billion. While their AUM has grown, their relatively smaller size compared to many of the larger asset managers we use in the Fund, gives them the ability to explore many smaller opportunities across asset classes whilst being a relevant player in the investment industry.

Truffle will manage a domestic-only, low equity multi-asset portfolio on behalf of the Fund. They currently manage a similar mandate within our STANLIB Multi-Manager Defensive Balanced Fund construct. As a highly skilled manager across asset classes – which has illustrated how well they can perform over changing market environments – we view Truffle as an excellent addition to the Fund.

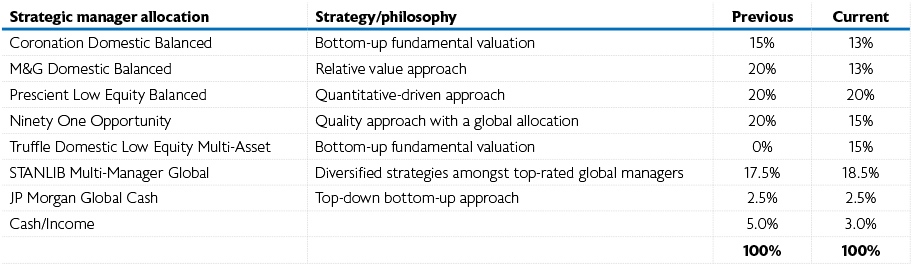

The strategic allocation to Truffle will be 15% of the Fund. To enable this allocation, we down-weighted other managers in a manner such that we are still able to meet the objectives of the Fund

A diversified blend of managers

The STANLIB Multi-Manager Real Return Fund has a robust blend of managers with varying approaches to investing. The table below provides a brief overview of the changes in the strategic manager allocation:

We are optimistic and excited about these changes and the expected future performance of the Fund. Currently, we are seeing excellent investment opportunities – especially within the local equity and fixed interest markets – and are confident that the adjustments to the Fund’s construct will ensure that it continues to deliver to its objectives.