Please be aware that there are risks in simply implementing these views into a portfolio without carefully considering the dynamic nature of the environment, how changes impact each asset class and the unique needs of each client.

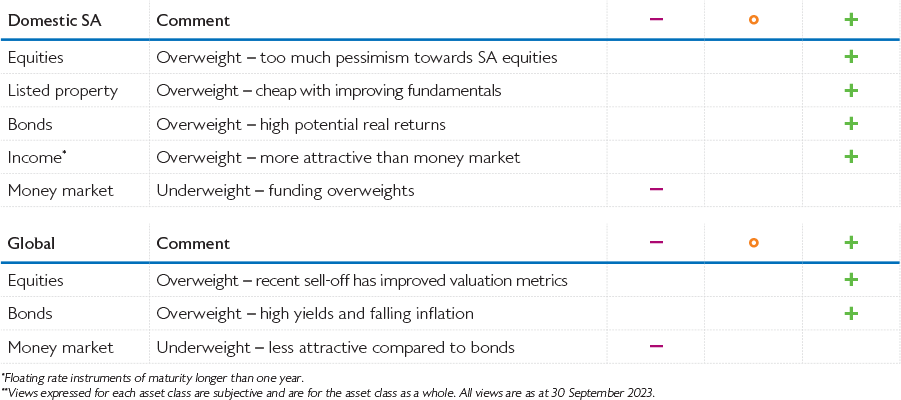

While our long-term real return assumptions are derived assuming that markets are in equilibrium, we do not believe that this is the case all the time. We therefore take views (tactically over/underweight) on relative asset class performance over three to 12 months, specifically ignoring shorter-term noise and not relying on long-term expectations i.e., we need to see the catalyst for the relative performance.

Domestic asset classes

Equities

- The FTSE/JSE Capped SWIX Index retreated 3.8% in Q3 as investors started to acknowledge the negative impact of the ‘higher interest rates for longer’ rhetoric from central banks.

- We started the year with a neutral position in equities and used the March and May sell-offs to increase our exposure to a marginal overweight. SA sensitive businesses have sold-off this year as the country struggles with loadshedding and poor economic growth. Weak growth in China also hurt the resources sector.

- We do not think current conditions are likely to persist into the near future so when the central bank induced sell-off happened in September, we again used the opportunity to increase our exposure.

Listed property

- The FTSE/JSE All Property Index started the quarter well, rallying 2.3% in the first two months as news broke that South Africa did not supply Russia with arms. In September property fell 4.1% as risk assets sold-off and the higher-for-longer theme took hold. Property was down 1.0% for Q3.

- We increased exposure in Q2 and bought more in September as we think valuations are attractive and fundamentals are improving. Loan to value ratios for the market have dropped from 42% during the height of the Covid pandemic to about 37% currently. Discount to net asset value for the sector is running close to 40%. Negative rental reversions have also moderated in recent months.

Bonds

- The FTSE/JSE All Bond Index recovered strongly from the sell-off in Q2 and continued to rally in July and August but like many SA assets, retreated in September to finish the quarter down 0.3%.

- We took some profits from bonds early in Q3, but continue to like them – yields remain attractive, the R2032 is yielding 11.7% while the R2040 yields 12.9%. For a country with an inflation target range of 3% to 6% we think current yields are unjustifiably high and should retreat when interest rates peak.

Income

- Income returned 2.0% in Q3 and was one of the best performing asset classes in South Africa.

- Given the increase in short-term rates, income yields have also risen and the spread to money market that income is offering is sitting at 182 basis points – this is very high.

- We continue to prefer income to money market and as a result have maintained our overweight exposure.

Money market

- The STeFi Composite returned 2.0% in Q3 as defensive assets performed better than risk assets.

- Yields on cash have gone up from the 2020 lows as the SARB, like other central banks, has been on an interest rate hiking cycle for the past two years.

- Despite the higher rates in the domestic market, we think there are better opportunities in longer duration assets and growth securities.

Global asset classes

Equities

- Global stocks also had a difficult time in Q3 as the Tech rally that started in January subsided on the back of higher bond yields. In US dollar terms, they fell 3.3%. The rand was 0.4% weaker in Q3, providing a small cushion for domestic investors.

- We used the sell-off as an opportunity to take a small overweight position in global equities. While higher interest rates and a possible slowdown in economic growth do not bode well for the equities, signs of lower interest rates in 2024 are starting to materialise as inflation continues to decelerate.

Bonds

- Bonds lost 3.5% during the quarter as bond yields sold-off from 3.8% to 4.6% in the US, 2.4% to 2.8% in Europe and 0.4% to 0.8% in Japan.

- Inflation continues to come down in most countries but the resilient labor market in United States has pushed out expectations of rate cuts. In fact, the market is now pricing in one more rate hike in November.

- For the first time in many years, we bought global bonds in Q3. Yields have gone up and we think we are near the peak of interest rate increases.

Money market

- Yields on money market instruments are higher compared to bonds but we think this is likely to reverse soon when central banks start cutting interest rates, hence our preference for bonds and equities. We also use money market to express our view on the domestic currency and our current view is that the rand is oversold – at time of writing the rand was trading at R18.97.