Markets hammered by rates ‘higher-for-longer’ and a weaker Chinese economy

It is all in the messaging

At this late stage of the interest rate cycle, the forward messaging is arguably becoming more critical than ever and is certainly seen by markets as being more important than the actual rate decisions. The US Federal Reserve paused interest rate increases last month, but this was overshadowed by projections for rates staying above 5% through to the end of next year. The central bank succeeded in shifting the focus from anticipation over the timing of the first rate cuts to realisation and acceptance that interest rates will remain higher-for-longer to bring down inflation.

On the other side of the globe, the European Central Bank (ECB) raised interest rates for the 10th consecutive time. In the most finely balanced decision since they started lifting borrowing costs last year, officials increased the deposit rate by another 25 basis points to a record 4%.

At their September meetings, the Bank of England (BoE) and Bank of Japan (BoJ) opted to hold interest rates steady. The BoE paused tightening after hiking 14 times in a row following an unexpected slowdown in inflation. In contrast, the BoJ offered no clear sign of a shift in its policy stance, putting a damper on market speculation for the prospects of a near-term interest rate hike and adding pressure on the yen.

China remains an outlier among global central banks, loosening monetary policy at a time when its major peers are raising interest rates to counter inflation. Core inflation in China remains weak, having been at or below 1.0% for 15 consecutive months. However, economic data shows that the Chinese economic recovery post-Covid is slowing at a faster-than-expected pace from both the production and consumption side. Subsequently, the People’s Bank of China (PBoC) cut its 1-year Medium-Term Lending Facility (MTLF) rate by 15 basis points to 2.50%. This is the second time the PBoC has cut the MTLF this year, confirming that the government is stepping up countercyclical easing measures to stabilise demand and support the recovery.

Who will the world rely on?

Perhaps we need to stop thinking of China as the would-be savior of the global economy. That would require an adjustment beyond moving a few forecasts up or down a touch. After the Chinese government lifted the punitive Covid lockdown restrictions, everyone assumed the economy would come roaring back. Instead, the opposite has happened, and the world’s second-largest economy faltering has global implications.

“Over the past decade, China has been the source of more than 40 percent of global economic growth, compared with 22 percent from the United States and 9 percent from the eurozone.” – BCA Research

The debate in China is about how much growth will slow, whether the country will suffer from deflation – consumer prices fell in July for the first time in two years – and how much action is needed to turn things around, or at least, prevent a further deterioration. On top of that, youth unemployment is more than 21%, and the yuan’s value has plummeted. Put politely, the message is that China will not provide the lift for the global economy that was widely anticipated six months ago. It may even be a drag, a role to which Beijing and the world are unaccustomed.

The house of cards is falling

China’s property market is in crisis. For decades, the economy was dependent on a booming real estate sector fuelled by population growth. The housing market created jobs and served as a place to store wealth for the growing middle class. Local governments were also dependent on revenue from land sales.

However, the country’s population is not growing the way it used to, and years of strict Covid-19 restrictions ‘disturbed’ Chinese consumers as the government tried to transition from an economy powered by state-directed investments and exports to one led by domestic consumer spending. Chinese consumers are spending less, in part because a slump in housing prices has affected their savings, much of which are tied up in property. Jobs tied to housing that were once abundant – construction, landscaping, painting – are disappearing. And the uncertainty of how far the crisis might spread is leaving companies and small businesses reluctant to spend.

| Years of excessive borrowing and overbuilding |

Chinese regulators started cracking down on reckless borrowing by property developers in 2020. This forced companies to reduce their debt levels before taking on more debt with subsequent trouble at heavily indebted developers. Country Garden – one of China’s largest property developers, which was involved in more than 3,000 property projects encompassing millions of houses – missed interest payments on two dollar-denominated bonds and is clearly struggling with liquidity issues.

In addition, Chinese property developer Evergrande Group filed for Chapter 15 bankruptcy protection, which allows a US bankruptcy court to step in when an insolvency case involves another country. The group is asking a US court to approve its restructuring plan to avoid bankruptcy and defaulting on its $340 billion debt load. The company faces a hearing on 30 October at a Hong Kong court on a winding-up petition, that could potentially force it into liquidation. In September Hui Ka Yan, the company’s billionaire chairman, was placed under ‘police control’, a clear sign that the saga at the world’s most indebted developer has entered a new phase involving the criminal justice system.

Chinese policymakers have defied calls to step in with a major rescue package for the embattled property sector. In its latest attempt to halt a slide in the country’s residential property market, policymakers have now moved to allow its largest cities to cut down payments for homebuyers and encouraged lenders to lower rates on existing mortgages. Mortgage-rate cuts will be negotiated between banks and their customers.

Shadow banking industry under the microscope

The property sector troubles are spreading to China’s financial trust companies. For years Chinese regulators have sought to get to grips with its $2.9 trillion trust industry – part of the country’s shadow banking sector that offers bigger returns than regular bank deposits but can be fraught with risk. Their fears were underlined in August when trust companies linked to financial giant Zhongzhi Enterprise Group Co., missed payments on several high-yield investment products.

These trust companies are loosely regulated firms that pool household savings to offer loans and invest in real estate, stocks, bonds and commodities. The sector was once seen as a safe place for wealthy Chinese to invest their money for high returns. But trust firms have defaulted on billions of dollars of investment products in recent years. Zhongzhi is a shadow banking giant with interests in trust companies, wealth management and private equity. Today it manages about 1 trillion yuan ($138 billion) in assets. One of its most important investments is a 33% stake in Zhongrong Trust, which has 270 products totaling 39.5 billion yuan coming due this year, according to Use Trust data. The average yield on those products amounted to 6.88%, compared with the benchmark 1.5% one-year deposit rate paid by Chinese banks.

The crisis at Zhongzhi feeds perceptions that poorly regulated parts of China’s banking industry may be ill-equipped to cope with those problems, increasing the risk of ‘contagion’, where an upset in one area of the finance industry can quickly cascade and cause a broader crisis of confidence.

More challenges

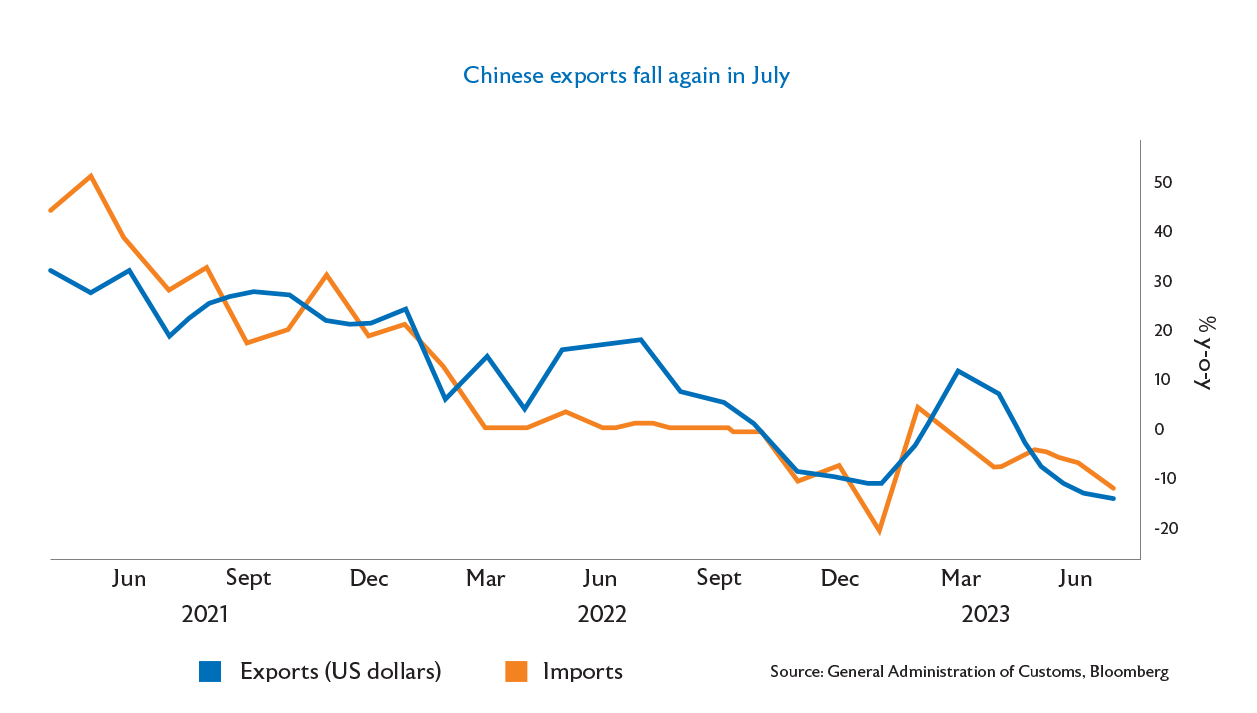

China’s trade surplus fell more than expected in July amid persistently weak demand both domestically and internationally. Year-to-date, the cumulative trade surplus stands at $489.57 billion, with exports down 5% and imports 7.6% lower. The ongoing ‘tech war’ with the US is not helping trade numbers. During the past quarter, Washington banned the sale of advanced microchips to China and restricted US investment in the Chinese tech sector. The ‘tit for tat’ continued and China has now banned government officials from using iPhones at work.

China’s trade surplus fell more than expected in July amid persistently weak demand both domestically and internationally. Year-to-date, the cumulative trade surplus stands at $489.57 billion, with exports down 5% and imports 7.6% lower. The ongoing ‘tech war’ with the US is not helping trade numbers. During the past quarter, Washington banned the sale of advanced microchips to China and restricted US investment in the Chinese tech sector. The ‘tit for tat’ continued and China has now banned government officials from using iPhones at work.

Global markets – higher-for-longer rates narrative

Evident by share price actions thus far, Wall Street is bent on fooling the masses. It has climbed the proverbial ‘wall of worry’ with extraordinary returns. But maybe, just maybe, the stock market is finally getting the message regarding higher-for-longer interest rates, which has spooked financial markets in the past month.

“Markets have not seemed to make much sense this year. They are starting to make sense again.”

– Richard Madigan (CIO) J.P. Morgan Private Bank

The S&P 500 lost 5% and the Nasdaq Composite dropped 6% in September. Both are still up a healthy 12% and 26% YTD respectively – mainly on the back of the artificial intelligence (AI) craze.

During the quarter, the US 10-year yield, a key benchmark for borrowing costs on everything from mortgages to corporate loans, hit 16-year highs around 4.5%. At the same time, yields on shorter-term Treasuries also jumped, with the two-year yield above 5%. The 10-year yield climbed about twice as much as the 2-year yield during September, reflecting the repricing toward higher-for-longer interest rates. Surging bond yields in the US over the past two months have ‘punished’ stocks, in particular tech stocks. Apple, Microsoft and Nvidia lost 10%, 4% and 10% respectively during September, after huge price increases earlier in the year.

“The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet and the cell phone.” – Bill Gates

Optimistic forecasts from Meta Platforms and results from Alphabet bolstered the case for those who believe the lofty valuations of mega-caps are still justified. Conversely, some investors have been looking outside of tech stocks for further gains, wary of rising valuations. Investors can now earn 5% with little risk in a US money market fund. That new found ‘competition’ could weigh on what investors will pay in the stock market for a potential cut in future company earnings.

The broader MSCI World Index dropped 4% in September, dragged down by the underperformance of US and Chinese stocks. It is, however, still up 10% YTD.

Global bonds

US yields are at their highest since 2007 but it is not just the in the US – the moves have been global. Despite inflation trending lower and the US nearing the end of the hiking cycle, yields in the US continued going up during Q3. Mainly on the back of stronger GDP data, ratings agency Fitch downgraded the US and its government’s need to issue more debt than it expected. All else equal, more supply of treasuries can put downward pressure on prices and upward pressure on yields. The Bloomberg Aggregate Bond Index subsequently dropped 3% in September and is down 2.2% YTD.

Roller-coaster for emerging market equities

Emerging market (EM) stocks gave up their gains for the year as stubborn inflation and bets on a prolonged period of high interest rates undermine growth prospects in the developing world. The MSCI Emerging Markets Index closed Q3 down 5% and 0.4% YTD.

“Market sentiment is awful. In a normal world, China would be the place to buy given they are the ones trying to

stimulate, but that is not happening.” – Greg Lesko, managing director at Deltec Asset Management LLC

Chinese stocks, which make up approximately 28% of the EM Index, extended their poor run as an exodus of foreign funds continued amid persistent concerns about the economy. The CSI 300 Index was down 3.5% in Q3 and 4.7% YTD. Scepticism that the measures will not be enough to arrest the economic slide is hammering stocks.

Locally, SARB kept lending rate unchanged

The SARB left the repo rate unchanged at 8.25% last month. This is the second consecutive time that the Monetary Policy Committee (MPC) has opted to keep rates steady, to the relief of many South Africans and businesses. It meant that the prime lending rate of commercial banks remained at 11.75%, following an aggressive hiking cycle of a cumulative 475 basis points since late 2021.

Inflation is now within the target range, despite a slight uptick in the latest CPI reading for August, which came in at 4.8% year-on-year. Although uncertainty prevails amid the dynamic impact of load-shedding, GDP growth is now likely to average closer to 0.5% this year. The rand ended September at R18.92 to the dollar. The latest rand weakness is mainly on the back of a surge in US treasury yields as investors turned away from riskier assets.

Near term bad news is the jump in the global oil price. From $74 dollars per barrel at the start of July, the price of Brent Crude has risen to $92, at the time of writing. It is difficult to tell how much higher the oil price might go since the price seems to be driven more by geopolitics – Saudi Arabia and Russia cutting back production – than by strong demand. In SA, this is further compounded by the rand’s weakness against the dollar. SA imports most of its fuel and the higher price puts its trade balance under more pressure.

Equity market down …no place to hide

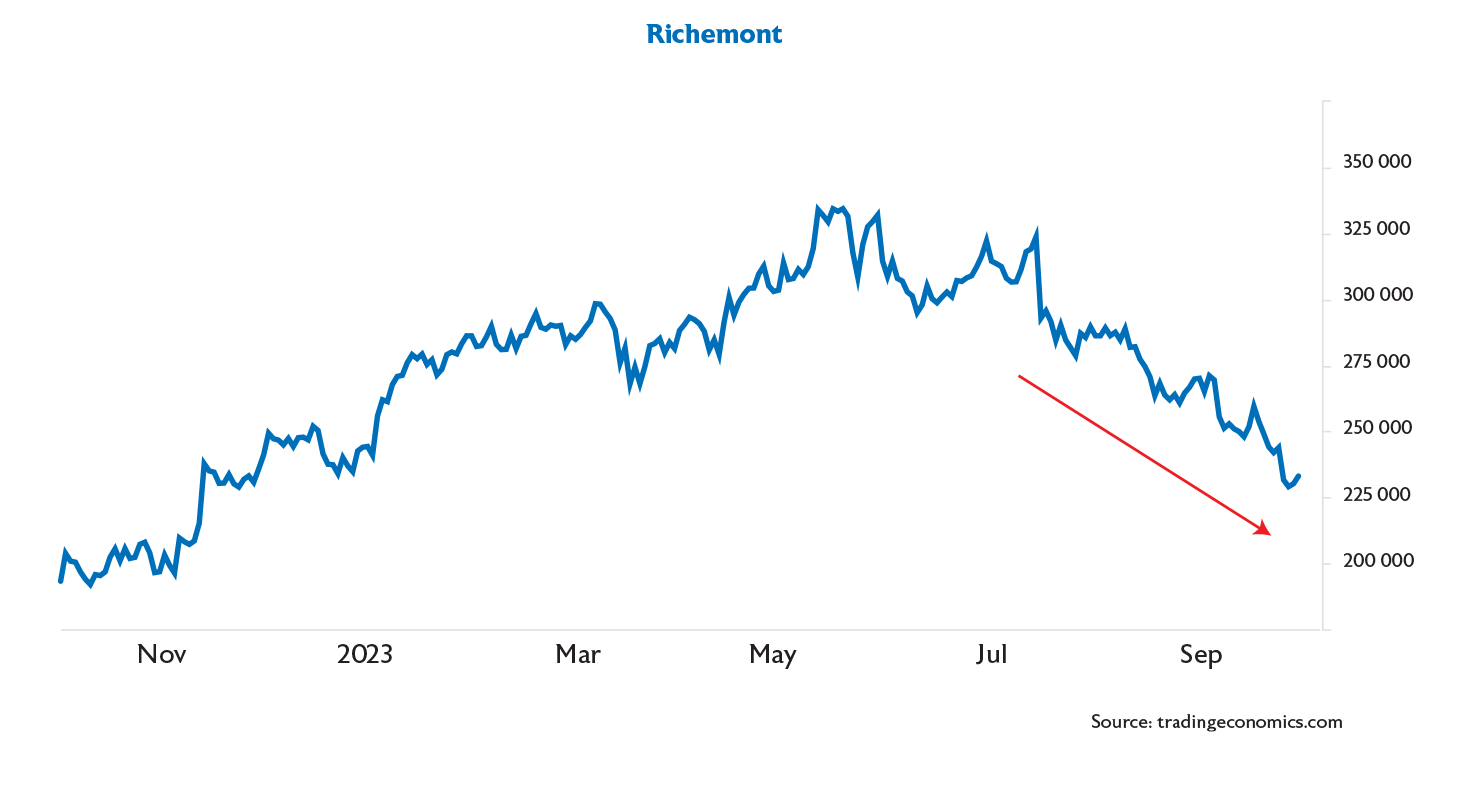

South African equities followed global peers lower, with the JSE All Share Index down almost 5% in Q3 2023. Financials gained 0.5%, led by Sanlam (13%), Capitec (10%) and Standard Bank (4%). However, industrials (-8%) and resources (-7%) dragged the market down. Richemont (-27%) was down due to unexpected declines in sales from the Americas. Naspers and Prosus lost 10% and 12% respectively because of China’s ongoing economic woes.

Resources were mainly impacted by platinum-group metals. Platinum, palladium, and rhodium prices were all down. Profitability followed the journey down the hill, as did the share prices of PMG shares. For example, Amplats was almost 20% down over the past three months.

Activity on the JSE

• Mastercard agreed to take a minority stake in MTN.

• Sanlam embarked on the unwinding of its unsuccessful R8 billion broad-based black economic

empowerment (B-BBEE) transaction initiated in March 2019.

• The Competition Tribunal prohibited the proposed merger of Vodacom’s fibre business and Remgro’s CIVH –

which includes Vumatel and Dark Fibre Africa – into a newly formed entity, Maziv.

• AngloGold Ashanti moved its primary listing to New York.

• South Africa’s weighting in the MSCI Emerging Markets Index has been reduced from September. Three

shares have been removed from the index – MultiChoice, Mr Price and Foschini.

Bond yields continue to surge

The JSE /All Bond Index is up only 2% YTD, after dropping 2.3% in September. Bond yields have climbed since February after the government signalled an increase in borrowing in the coming years to finance a debt-relief plan for Eskom, and now amid concerns over the budget deficit, fuelling concerns it will have to flood an already near-saturated market with increased bond issuance.

Property stocks lagging

The Property Index lost another 3.8% in September and has lost 4.5% YTD. While the market is pricing in particularly poor outcomes, there is evidence of improving fundamentals. Balance sheets are less leveraged with lower LTV ratios – a company’s nominal debt against the value of its underlying properties – and a higher percentage of retained income. Many property companies have also been investing heavily in becoming less reliant on the national power grid, which could potentially improve the long-term sustainability and resilience of their operations. Valuations in the market appear attractive and positive rental reversions and better-than-expected earnings could see a re-rating in the sector.