Please be aware that there are risks in simply implementing these views into a portfolio without carefully considering the dynamic nature of the environment, how changes impact each asset class and the unique needs of each client.

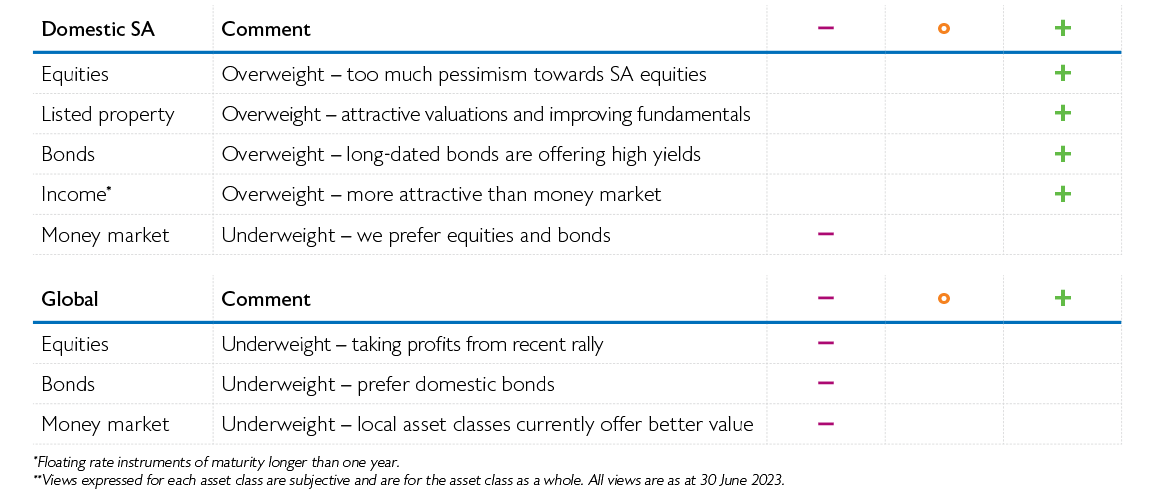

While our long-term real return assumptions are derived assuming that markets are in equilibrium, we do not believe that this is the case all the time. We therefore take views (tactically over/underweight) on relative asset class performance over three to 12 months, specifically ignoring shorter-term noise and not relying on long-term expectations i.e., we need to see the catalyst for the relative performance.

Domestic asset classes

Equities

- The FTSE/JSE Capped SWIX Index brushed off Stage 6 load-shedding, rallying 3.4% in April as investors believed global central banks would pivot in the wake of lower inflation prints. In May, news that SA may have supplied Russia with arms in December, sent markets into a tailspin – selling off 5.8% before recovering 3.8% in June. SA equities rallied 1.2% in the second quarter and are up 3.6% in 2023.

- We started the year with a neutral position in equities and used the March and May sell-offs to increase our exposure to a marginal overweight. SA-sensitive businesses have sold-off this year as the country struggles with load-shedding, poor economic growth and a possible backlash from developed economies on its stance on the Russia/Ukraine conflict.

- Poor sentiment towards SA assets has improved valuations, providing us with attractive long-term buying opportunities.

Listed property

- Although the FTSE/JSE All Property Index was up 1.0% in Q2, sentiment towards property in South Africa remains negative. In 2023, it has lost 3.9%.

- SA property had its worst month in May, losing 5.3% as investors indiscriminately sold SA-sensitive assets.

- We increased exposure in Q2 due to attractive valuations. Loan to value ratios have dropped from 42% during the height of the Covid pandemic to about 37% currently. Discount to net asset value is running above 35%. Fundamentals are also improving with rental reversions starting to moderate.

Bonds

- The FTSE/JSE All Bond Index had a good month in June, gaining 4.6% but that was not enough to undo the damage caused by the sell-off in bond yields in April and May. In Q2, bonds fell 1.5% and year-to-date, have only gained 1.8%.

- Despite the negative returns in Q2, we continue to prefer local bonds especially the long end of the yield curve – the R2032 is yielding 11.1% while the R2040 is at 12.3%. Current pricing suggests that investors expect inflation to remain above the 6% upper limit of the SARB’s band over the next 10 years.

- We believe investors are too pessimistic on South Africa and hence, current yields are unjustifiably high.

Income

- Yields on short-dated bonds also rallied in June to produce a total return of 2.5% but like bonds, income only managed to produce a return of 0.5% in Q2. In 2023, it is up 2.9%.

- The spread to money market came down to 148 basis points in June but is still significantly higher than the long-term average of 70 basis points.

- We continue to prefer income to money market and as a result have maintained our overweight exposure.

Money market

- Cash as measured by the STeFi Composite Index returned 1.9% in Q2 and is up 3.7% in 2023.

- The SARB hiked interest rates by 50 basis points at its April meeting to dampen inflation. It appears that the central bank cannot afford to pause the hikes as this would put its inflation targeting mandate at risk.

- Despite the higher rates in the domestic market, we still prefer longer duration assets and growth securities.

Global asset classes

Equities

- Global stocks rallied 6.3% in Q2 in US dollar terms and 12.3% in rand terms as technology companies regained their 2020/2021 glory days. Year-to-date, global equities are up 12.8% in US dollar terms.

- Global markets and investor sentiment have improved in 2023, economic growth has been stronger than expected, inflation has fallen perhaps faster than many investors initially thought, and despite higher-for-longer interest rates, global companies have produced strong returns.

- As the rand weakened in Q2, our overweight position shot up and we used the rally to take some profits from the asset class. Furthermore, at this point we find domestic assets more attractive than global assets.

Bonds

- Bonds pulled back 1.4% in Q2 in US dollar terms but gained 9.1% in rand terms as the domestic currency sold-off. In 2023, global bonds are up 1.6% in US dollar terms and 16.6% in rand terms.

- Although the US Federal Reserve decided to keep interest rates unchanged at its June meeting, the market is pricing in more rate hikes for 2023.

- We are underweight global bonds – from a relative valuation point of view, we prefer domestic bonds.

Money market

- This is our default asset class and is used to increase/decrease our offshore exposure. We think the rand is weak and has the potential to strengthen should the US Fed pivot on its interest rate policy. At time of writing, the rand was trading at R18.72 to the US dollar.