Please be aware that there are risks in simply implementing these views into a portfolio without carefully considering the dynamic nature of the environment, how changes impact each asset class and the unique needs of each client.

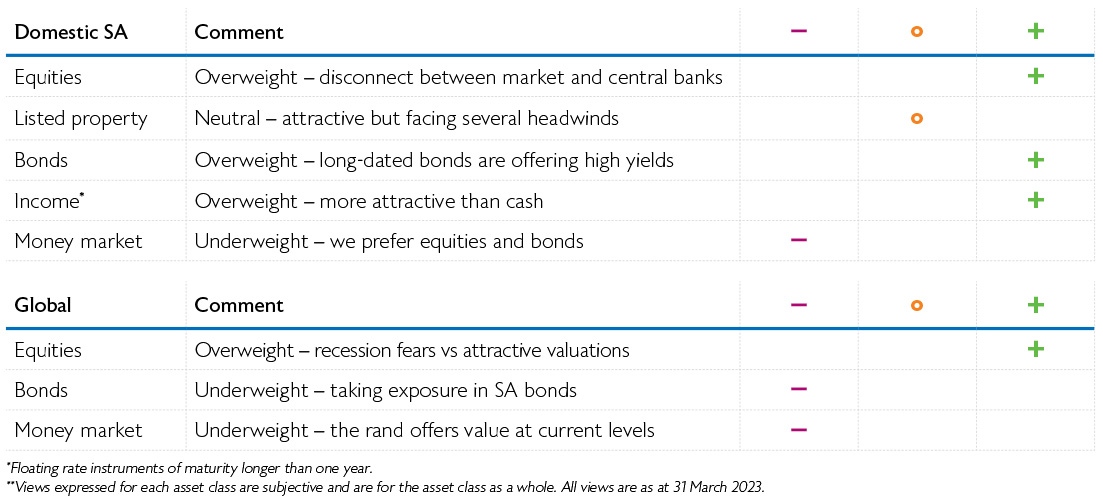

While our long-term real return assumptions are derived assuming that markets are in equilibrium, we do not believe that this is the case all the time. We therefore take views (tactically over/underweight) on relative asset class performance over three to 12 months, specifically ignoring shorter-term noise and not relying on long-term expectations i.e., we need to see the catalyst for the relative performance.Domestic asset classes

Equities

- The FTSE/JSE Capped SWIX Index started the year strong, rallying 7.0% in January before sentiment shifted toward the reality of higher-for-longer inflation, as well as interest rates. Despite falling 4.2% in February and March, it still finished the quarter 2.4% ahead.

- We started the year with a neutral position in equities but were looking for opportunities to increase exposure as valuations were attractive. When the market became too pessimistic in March, we started adding to equities but not aggressively. We think there will be more opportunities later this year to increase exposure.

- The environment remains challenging. On the one hand, the market is expecting central banks to pivot but on the other hand, central banks are still raising rates as inflation remains high. In time, we will know whether the market or central banks were correct in their views. This is part of the reason we are not currently aggressively buying equities.

Listed property

- Following the 18.2% rally in Q4, property retreated 4.8% in Q1 as loadshedding hit shopping centres hard. Retail companies like Shoprite and Pick n Pay are spending more than R60 million per month on backup power.

- We are neutral on property as we weigh the escalating power and municipal costs, together with higher interest rates against the cheaper valuations, improving trading densities and strengthening balance sheets.

Bonds

- Bonds performed better than growth assets in Q1, rallying 3.4% as yields in the 3-7 year and 7-12 year buckets fell by 32 basis points on average.

- We continue to prefer bonds as the long end of the curve remains attractive. The R2032 is yielding 10.6% and the R2048 is at 11.85%. In addition, inflation is coming down, improving the prospects of making high real returns from the asset class.

Income

- Short-dated bonds also produced positive returns, up 2.4% in the first quarter of 2023.

- We acknowledge that the interest rate hikes by the South African Reserve Bank have caused yields on these bonds to reprice higher, thus hurting total returns. However, we still think income offers an attractive spread to cash – 160 basis points.

Money market

- This is our default asset class. The SARB surprised investors with a 50-basis point interest rate hike in its March meeting, pushing the 3-month Jibar to 7.96%. Despite the higher rates, we still prefer longer-dated fixed income instruments.

Global asset classes

Equities

- Global stocks returned 7.4% in US dollars terms for Q1 and 11.3% in rands as the market started pricing a higher probability of a US Federal Reserve pivot. The Chinese re-opening trade also supported the asset class.

- We are marginally overweight equities – the 24.5% sell-off in the first 9 months of 2022 improved valuations. Although equities will do well if the market is correct on its interest rate expectations, we are balancing this view against the looming risk of a recession as the yield curve remains inverted.

Bonds

- For the first three months of the year, bonds produced 3.0% in US dollar terms and 7.7% in rands as the market weighed the continued interest rate hikes against the decelerating inflation figures.

- We remain underweight bonds. While bond yields have sold off in the past year, we prefer South African bonds to global bonds.

Money market

- This is our default asset class and is used to increase/decrease our offshore exposure. At this point, we prefer domestic assets to offshore assets. We also think the rand is weak and has the potential to strengthen should the US Fed pivot on its interest rate policy and the dollar weakness accordingly. At time of writing, the rand was trading at R18.36 to the US dollar.