Imelda Watkins

STANLIB Multi-Manager:

Portfolio Manager

Key points

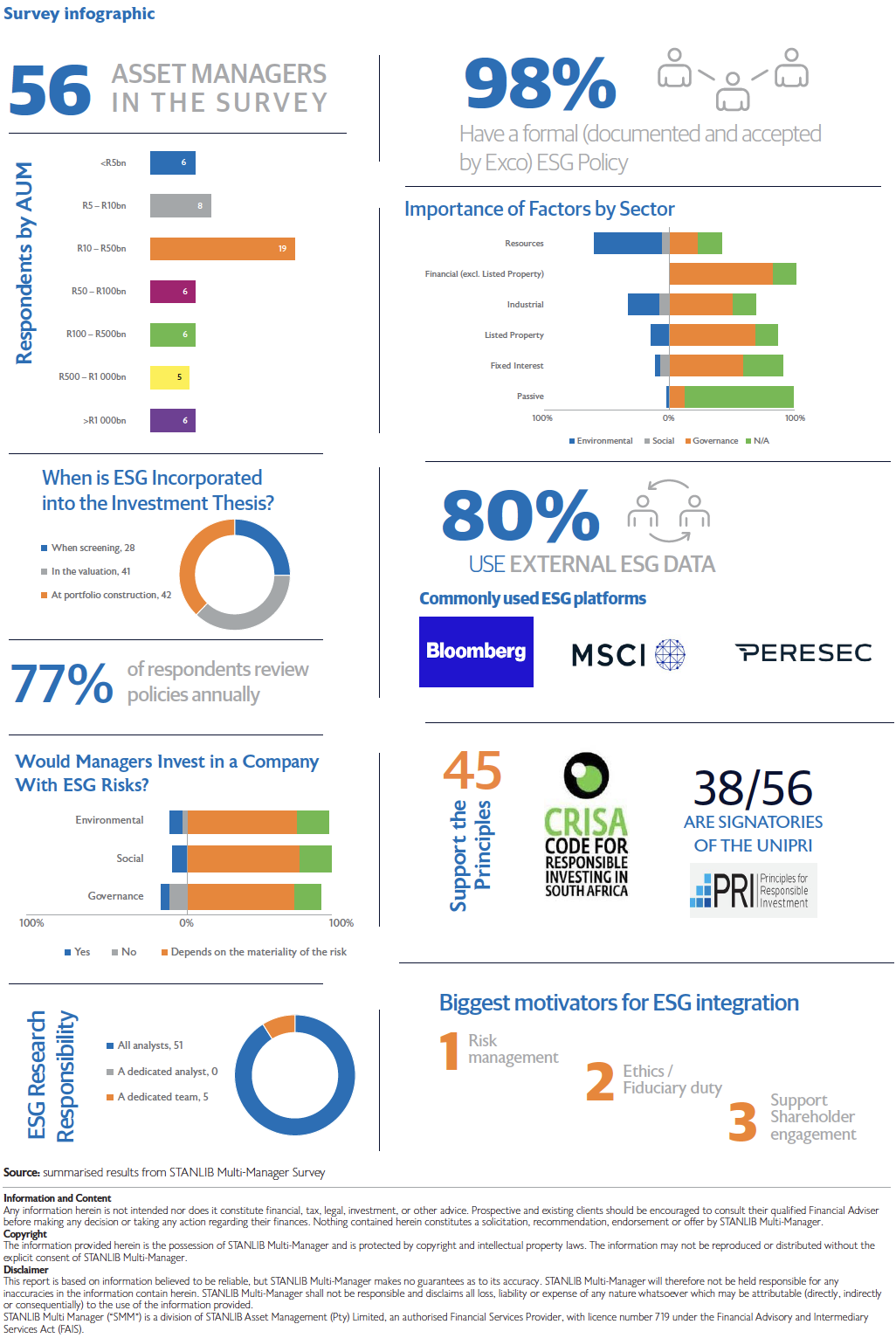

- Our latest survey showed that the integration of ESG within the investment process continues to be an important consideration for managers with ownership being taken by those closest to the investment decision-making process – analysts and portfolio managers.

- 55 out of 56 managers have ESG and proxy voting policies in place. This is an improvement from the previous survey.

- Governance continues to be the main focal point, with environmental continuing to be most important for resource companies. Although managers do not explicitly address the social factor, the focus on governance and environmental could lead to more sustainable businesses, which has an indirect positive impact on society as a whole.

Introduction

As a Discretionary Fund Manager (DFM) ESG investing is an important component of our research process through our indepth manager due diligence processes, which culminates in our rating of a manager. Once an underlying manager has been appointed, our portfolio managers and manager research analysts continue to assess whether that manager’s investment decisions align with their purported policies and processes – including ESG – on an ongoing basis.

In 2020, we conducted our inaugural survey, which focused on the integration of ESG factors into the investment processes of South African investment managers. This year, we again requested managers to complete the survey to assess whether the integration of ESG had evolved over time.

Methodology

56 investment managers participated in the survey, representing a response rate of 95%. Compared to the previous survey conducted in 2020, there was an increase of 17% in the number of respondents and 63% overlap between the respondents in the two surveys. This allows for meaningful comparison between the surveys. Participants represented asset management firms across the size spectrum.

To closer align our asset class perspective with the UN Principles for Responsible Investment (PRI) Manager Selection, Appointment and Monitoring (SAM) reporting model, we classified the asset class coverage for equity, fixed income, and property into active and passive management capabilities. It should be noted though that none of the participants focus exclusively on passive investing and not surprisingly, from a South African investment perspective active capabilities by far outweighed their passive counterparts.

The matters addressed in the survey sought to understand each investment manager’s approach to ESG integration by, amongst others, interrogating:

- Where the responsibility and ownership for ESG integration resided;

- At which stage in the investment process managers incorporated ESG factors;

- Which factors they found most relevant depending on the sector or asset class being evaluated; and

- The adoption of various related policies.

Key findings: integration into investment process

- 73% of respondents said the responsibility for ensuring investment activities were aligned to established firm policies on ESG resided within the investment team – portfolio managers and the research team.

- 91% of respondents said it was the responsibility of all analysts. This aligns to the results of the previous survey.

- The majority of respondents do not use ESG analysis as a screening tool – positive or negative – but rather it is incorporated at the portfolio construction stage and in the valuation process. We think that this is a prudent approach given the smaller SA markets.

- With regards to how ESG is accounted for in the valuation process, most respondents said it was incorporated into the discount rate and formed part of scenario analysis.

- ESG research is viewed as part of the regular investment process by 96% of respondents and not as a separate specialised process. This aligns to our findings in the previous survey (100% of respondents) indicating the continued importance of the ESG consideration and integration within the investment process.

- The primary motivation provided by managers for integrating ESG into the investment process was to use it as a risk management tool. This is consistent with the previous survey where superior risk-adjusted returns had the most responses.

- ESG consideration and integration is therefore a key tool in mitigating investment risk. Most respondents (>60%) indicated the decision to invest in a company with Environmental, Social or Governance risk would depend on the materiality of the risk. This was aligned to the previous survey response.

- In contrast to the 2020 survey, we split the E,S and G factors to see whether the decision to invest was different based on the issue considered. The difference in responses per category indicated it was not.

- Interestingly, irrespective of the equity sector or asset class capability, social issues ranked the lowest (and in the case of the financials sector, zero) in terms of importance. Not surprisingly, environmental issues had the highest ranking in terms of importance for the resource sector. Governance had a high ranking across most sectors.

- Where ESG was not considered in the management of fixed income investments some of the reasons provided were that they were managed passively or that ESG analysis and engagement were the ambit of the equity team. One respondent said ESG was more applicable to equity management and respondents also said they did not consider ESG as the fixed interest exposure was through SA Government Bonds.

- All the respondents who do not consider ESG in the management of their passive capabilities said the strategy did not require the consideration. We think this is partly true as the objective of passive funds are to track the reference index as closely as possible, which requires matching most of the index’s underlying holdings. However, this does not mean that passive managers cannot be active owners and exercise the rights afforded them through stock ownership. Given that the survey respondents were predominantly active asset management houses, we believe it is a fair assessment that active engagement does occur but is driven by the active investment teams.

- 80% of respondents use an external provider to supplement their ESG research. This is an increase from the 2020 survey where 67% of respondents used an external ESG provider. Bloomberg and Legae Peresec were the most used providers. Similar to the previous survey, a high number of respondents (82% in 2022 and 72% in 2020) said their final ESG assessment depended less than 50% on the external data. This is indicative of managers applying their philosophies and processes to the data provided.

Adoption of policies

We asked whether managers had established ESG and Sustainable Investing policies in place.

ESG – we are pleased that all but one said they had a policy in place and one respondent was in the process of getting it signed off. This is a continued improvement from the previous survey where 90% of respondents had an established ESG policy.

Proxy voting – again, all but one said they had a policy in place and the one respondent was in the process of getting it signed off. This was aligned to the previous survey results.

Environmental impact – 50% of respondents said they did not have an environmental impact policy in place and 16% said they were in the process of formulating one.

Social impact – 57% of respondents said they did not have a social impact policy in place and 14% said they were in the process of formulating one.

Separate sustainability policy – 50% of respondents said they did not have a separate sustainability policy in place and 20% said they were in the process of formulating one. 77% of respondents said policies were subject to an annual review, which is good.

Adoption of relevant codes

CRISA – 90% of South African respondents endorse the Code for Responsible Investing in South Africa (CRISA). Those respondents who indicated that they do not endorse CRISA said they were following the principles espoused by CRISA and some were on the path to formally endorsing the Code.

UNPRI – 68% of respondents said they were signatories to the United Nations Code for Responsible Investment (UN PRI). Of those respondents that were not signatories, 24% said they were in the process of becoming signatories and a similar percentage cited the cost as the reason they were not signatories. The majority of respondents (54%) did not measure their investment activities relative to the 17 UN Sustainable Development Goals. Most managers, however, considered the principles of the UN Sustainable Development Goals even if they did not have specific goals they targeted. The top 3 goals specifically targeted were Goal 3 – Good Health and Well-being, Goal 13 – Climate Action; and Goal 7 – Affordable and Clean Energy.

Examples of shareholder activism – Environmental perspective

Sasol and its plan to reduce carbon emissions and path to net zero by 2050 was by far the most common example cited by managers on the shareholder activism or engagement from an environmental perspective.

Examples of shareholder activism – Social perspective

Board diversity was a common example cited by managers, as well as safety practices of mining companies. Santam and its payout of lock-down claims was also highlighted.

Examples of shareholder activism – Governance perspective

Engagement issues centered on board composition and remuneration. The Naspers/Prosus share exchange and managers involvement in the collaborative stakeholder approach followed by the industry was also mentioned by a number of respondents.