Should you increase your foreign allocation?

Joao Frasco

STANLIB Multi-Manager:

Chief Investment Officer

Key points

• The offshore investment limits for local unit trusts that are mandated to invest offshore – including those that comply with the retirement fund regulations – have increased to 45%.

• Local asset managers and pension funds need to consider what this means for the strategies that they manage on behalf of investors.

• Individuals need to consult with their financial advisers to understand the implications for their specific needs and circumstances.

Introduction

In delivering the budget speech on 23 February 2022, the Minister of Finance announced a further relaxation in exchange controls for South African investors, with details that followed in Exchange Control Circular No. 10/2022.

The offshore limit for all insurance, retirement and savings funds has been harmonised at 45% inclusive of the 10% African allowance. Before the increase, institutional investors could invest a maximum of 30% offshore, with an additional 10% in other African markets. Under the new dispensation, managers can invest 45% of their portfolios anywhere globally. Unit trust companies can invest up to 45% of their client assets under management offshore, up from 40% outside Africa + 10% for Africa ex-SA.

What does this mean for South African investors and their advisers? And what is the impact on asset managers that manage Collective Investment Schemes and other wrappers? In this short article, I will briefly address these questions.

First principles approach

From a first principles approach, there should be no question that any investment decision should depend on the needs and circumstances of the individual investor. There is therefore no single correct answer as to how much foreign exposure an investor should have, without going through the process of understanding their needs and circumstances. Simply focusing on the average investor for example, is certain to provide the incorrect answer most of the time, since no single investor will be represented by the average. This creates a good opportunity for advisers to spend time with their clients to understand their individual needs and circumstances, and establish the appropriate foreign exposure based on the results of this engagement.

– There is no single correct answer as to how much foreign exposure an investor should have…

Theoretical optimisation

We can, however, perform a theoretical mean-variance optimisation to establish an efficient frontier of strategic asset allocations that will minimise risk – variance or volatility – for a given level of return; or equivalently, maximise the return for a given level of risk. Although the technical details of this optimisation exercise are beyond the scope of this article, it is important to note that it depends on some key assumptions around expected returns and risk. We also need to include various constraints into this optimisation exercise, including no shorting, no leverage, and the 45% foreign allocation.

The result of this optimisation exercise is a wide range of efficient portfolios that advisers and investors can select according to their specific needs and circumstances. Asset managers can also build and manage portfolios using this efficient frontier and typically will create a range of portfolios, say three or five, along the efficient frontier to meet varying investor needs and circumstances.

Optimisation results

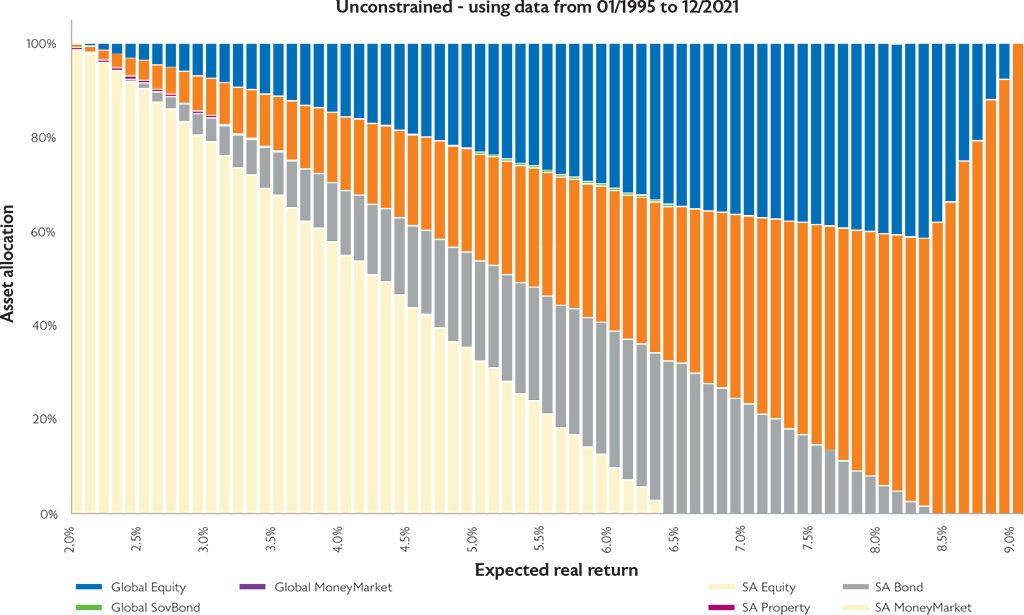

It is often best to first look at an unconstrained optimisation – beyond the constrains mentioned above of no shorting and no leverage. The chart below shows the asset allocation across the efficient frontier for this exercise. The optimisation is done in real return terms, which implies that we perform the optimisation after the removing the effects of inflation. The reason for this is that nominal returns (returns before inflation) are meaningless in the context of the ravages of inflation to the purchasing power of savings.

You will note that the real returns range from 2% p.a. real, for money market funds, to 9% p.a. real for local equity funds. Please remember that these are long-term expected real returns and actual returns can and will vary significantly from these expectations. Each of the real return expectations also comes with an expected risk, which we model using real volatility and will be part of the efficient frontier which we have not included here.

The important thing to note from the chart above is how the foreign allocation reaches just above 40% but does not reach the foreign limit of 45% allowed by the new regulation. An investor looking for a diversified portfolio could therefore consider a 40% foreign allocation as a strategic starting point, ignoring any specific short-term asset class or stock specific views.

– Optimisation results limit offshore to only 40% – below the new limit of 45%

Given how vocal many market participants have been around the appropriate foreign allocation in an unconstrained world, why does the modelling not allocate more to foreign that the 45% allowed? There are many reasons for this, but the most important two follow.

Firstly, in our assumptions, local equities as a basket, are expected to outperform global equities (also as a basket dominated by developed markets). This follows from a simple assumption of a higher risk premium for local (emerging market) equities relative to global equities.

Secondly, because we are considering a South African investor targeting real returns in rand terms, this makes foreign assets risky when converted back into rands because of exchange rate volatility. This is why it is important to understand the needs and circumstances of an individual investor, as their goals and risk may be denominated in another currency, in which case, this analysis would not yield the ‘correct’ results.

Investors seeking lower risk and return solutions would not come close to the 40% foreign allocation, as can be seen by moving towards the left along the chart above.

Conclusion

Although the relaxation of exchange controls is very welcome, it should not be considered a ‘slam-dunk’ that all investors should increase their foreign allocation, or that all portfolio managers should increase the foreign allocations in the various portfolios they manage. Higher risk portfolios and investors may want to use the full allocation, but they should understand the risk, specifically currency, that comes with this decision. Lower risk investors and portfolios should probably not approach the 45% limit. We urge you to spend time with your adviser and re-examine your individual needs and circumstances, especially risk appetite, before deciding how to proceed.