Part 2: Contributing towards your retirement fund(s) – the impact of CGT on your retirement savings deduction

Albert Louw

Head of Business Development

Review – three limitations to be considered

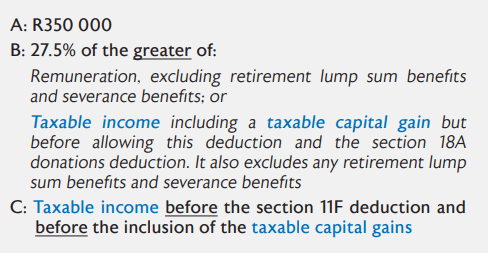

The amount of the deduction in a particular year of assessment is limited by Section 11F to the lesser (smaller) of A, B and C below:

‘Taxable income’ vs. taxable income – be mindful of the context in which the words are used

Taxable income is used to determine the maximum amount you can deduct for tax purposes for retirement contributions.

However, you need to be cautious when applying Section 11F as SARS uses the words taxable income in two instances, which can create confusion. (1) For determining the maximum amount you can deduct for tax purposes for retirement contributions, and (2) to determine your final tax liability.

The following examples illustrate the above application

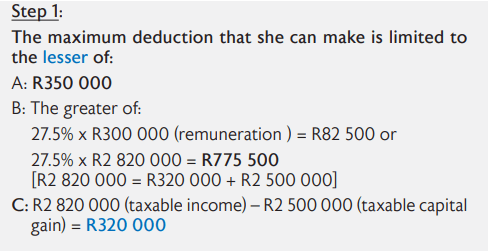

The calculation is a three-step process:

- Calculate your retirement fund deduction by applying Section 11F

- Add your taxable capital gain to calculate your taxable income

- Apply the tax tables to determine your tax liability.

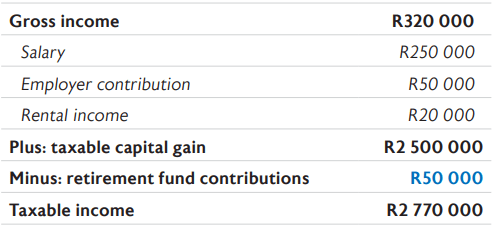

Example 1: R50 000 contribution

- Mrs Selinda earns an annual salary of R250 000

- Her employer contributed 20% (i.e. R50 000) to a pension fund on her behalf

- She also earned rental income of R20 000 (no expenses incurred)

- She incurred a taxable capital gain of R2 500 000 after selling shares from the portfolio she inherited from her late father.

The deduction will be limited to the lesser of the three amounts in bold, which is R320 000. Mrs Selinda only contributed R50 000 and therefore can deduct the full amount of R50 000 for tax purposes.

To the extent that a taxable capital gain is included in taxable income, it will increase the potential

deduction and ‘saving more tax’ for that year of tax assessment.

Step 2:

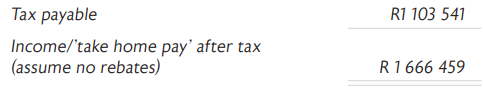

The following applies under the tax table:

Step 3: