Investing offshore – be aware of the impact of Capital Gains Tax (CGT) when selecting a rand or a foreign-denominated portfolio

Albert Louw

Head of Business Development

Background

When contemplating an investment offshore, before deciding on the type of portfolio and/or platform that will meet your requirements, you need to decide whether you want to invest in a rand-denominated fund or use your foreign allowance.

Rand-denominated

You want a simple solution and do not want to expatriate assets. There are a number of advantages with a rand-denominated investment, which include not needing to buy foreign currency; nor needing tax clearance from the South African Revenue Service (SARS).

Foreign-denominated

You can invest directly offshore using your South African Reserve Bank (SARB) offshore allowance of R11 million. There is no tax clearance required from SARS for the first R1 million of your investment. The next R10 million is subject to the exchange controls of the SARB. These controls allow South African investors to invest up to R10 million offshore annually, so long as the investment is accompanied by a tax clearance certificate.

Potential CGT implications

An important aspect which could steer the direction of your investment decision, is CGT. In a rand-denominated fund, any currency* gains when you sell units from your Collective Investment Scheme (CIS) or unit trust, would attract CGT. The impact of this could be meaningful when you consider that the current inclusion rate for CGT is 40% and not only 10% when CGT was implemented.

* Based on the assumption that the rand will depreciate against other global currencies over time.

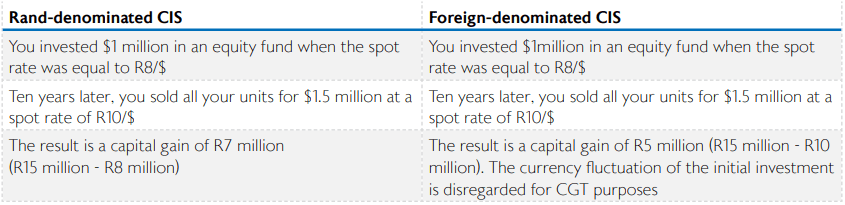

A simple example

The impact of CGT on offshore investments

In the example above, opting for a foreign-denominated fund would have saved you R321 440# in income tax when selling your equity investment after 10 years.

#Assume you are taxed at a marginal tax rate of 41% [R2 000 000 – R40 000 (annual exclusion) x (40% x 41%)]

Conclusion

This issue of Educator aims to demonstrate how CGT can affect your decision of how to invest offshore – it is not simply about when to invest, the time period and type of portfolio. Being fully informed can prevent surprises when your service provider presents you with your IT3 C tax certificate.

STANLIB Multi-Manager is not a tax professional. Please seek the appropriate assistance/advice from a qualified financial or tax adviser.