The enhanced diversification potential in global markets

Kent Grobbelaar

Head of Portfolio Management (Offshore),

STANLIB Multi-Manager

In this article, I will try to address some of the issues which come up when looking at the diversification benefits of offshore investing, however one should be mindful of the fact that everyone is different. Circumstances change, attitudes to risk differ and individual goals vary. As such there is no such thing as one size fits all. I will therefore draw on personal experiences but also express STANLIB Multi-Manager’s best investment view to assist our clients in making informed decisions.

It’s not all about the base (currency)

I was born in 1974. Since then the rand has lost 94% of its value against the dollar (in nominal terms). It would therefore come as no surprise most people would list hedging against further currency depreciation as one of the greatest benefits of investing offshore. In some instances it is those very same people who may have recommended investing in BRICS (Brazil, Russia, India and China). This was after all the fastest growing countries with favourable population dynamics and which didn’t suffer from the indebtedness of many of their developed market counterparts. The fact that the Russian rouble and Brazilian real depreciated by more than the rand over the last 5 years highlights the importance of, “where” in the equation. Suffice it to say the reasons for the rands’ plight such as political risk and commodity sensitivity are well documented so there is no need to elaborate further. The point is: given the constraints as a result of exchange control, one should maximise the diversification potential through investing in uncorrelated assets and a weak rand is only a part of a broader consideration.

The world is your oyster

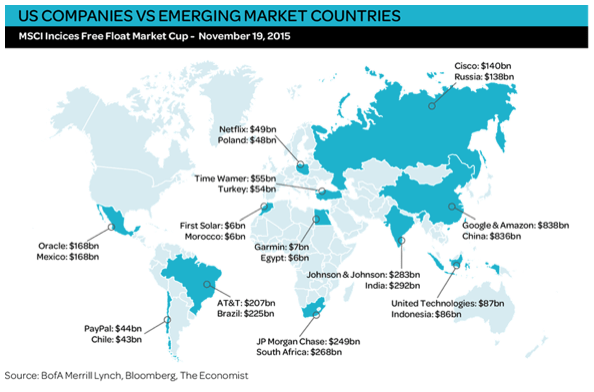

Almost 20 years ago I started my career in the offshore division of what was then Standard Bank Fund Managers. This coincides with the relaxation of exchange controls and much has happened during my tenure with the group. Throughout the period though, I would say one of the biggest lessons learnt was how broad the opportunity set to invest offshore is. Forget currency and makeup of the JSE for a second. Imagine for a minute you were the head of Jupiter’s Sovereign Wealth Fund. You’re looking at planet earth and deciding where to invest. I suspect from the map below you would not allocate much more than say 5% to South Africa. It illustrates how small our economy is relative to the market capitalisation of some multinationals and it is these companies, rather than South Africa Inc, which will probably attract your attention.

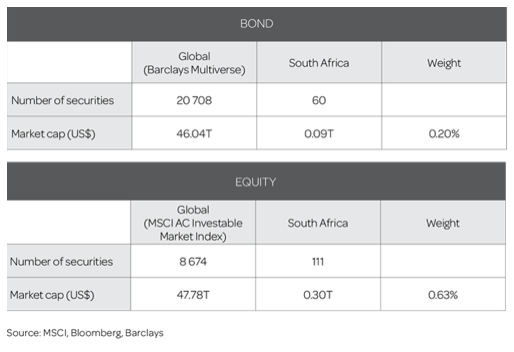

If you were the Chief Investment Officer of said fund, another way of looking at this would be to consider SA equity and bond markets relative to the rest of the world. When viewed in this context it becomes clear a home bias really and truly limits what you can invest in. We represent a mere 0.2% of global debt indices with only 60 securities out of 20 708 in the broader Barclays Multiverse index. Similarly, we pale into insignificance in the equity space – see below.

A more efficient frontier

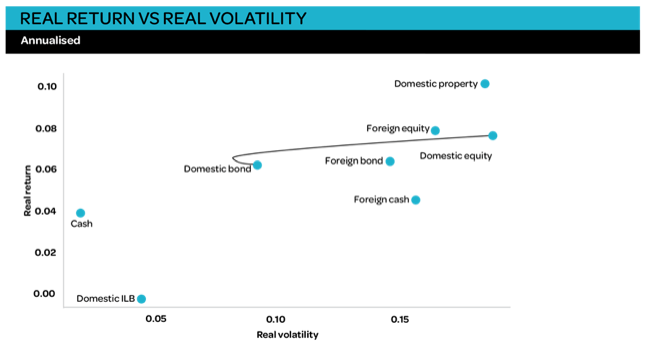

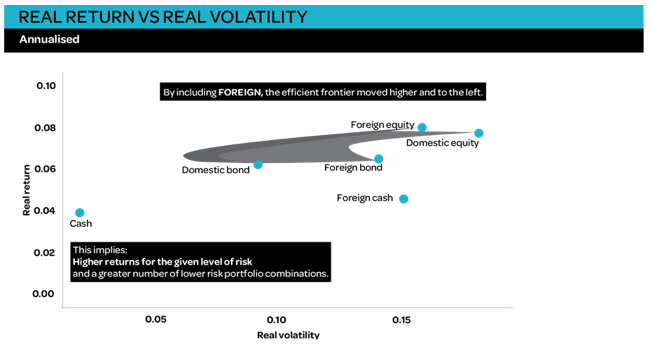

Having spoken to many clients over the years it’s been apparent SA investors are woefully underweight in offshore assets. If diversification is sound for a nation whose stock markets represent half the globes market cap (USA), how much stronger is the argument for SA investors where the JSE is a mere 0.63% of the investable universe? Put differently, we believe the 25% permissible offshore within pension funds is not sufficient diversification (bearing in mind most of an individual’s net worth is probably in their house and other local assets). To help articulate the point, take a look at the next two graphs. The first is a frontier highlighting various combinations of domestic equity and bond portfolios using historic returns over the past two decades.

Should foreign equities and bonds be included, we would only observe a diversification benefit if portfolios generated superior returns, lower risk or both. We assess this by calculating real rand returns versus real risk as measured by annualised standard deviation of real returns, also known as volatility. If the return per unit of risk rises when adding foreign assets, the portfolio is being enhanced. The second graph shows a frontier with the inclusion of both foreign and domestic equities and bonds. By doing this, it’s clear one experiences greater risk reduction, higher returns and therefore more efficient portfolios.

Idio(t)syncratic risk

We believe it does not make sense taking on risks which are easily diversifiable. To this end another problem facing local investors is that certain sectors are not well represented in SA. Using Information Technology (IT) as an example, SA simply does not have the depth and variety of technology companies available to American and European investors. Other sectors which are either virtually non-existent or poorly developed are healthcare and utilities.

Within the aforementioned sectors there are also concentration issues at security level i.e. the table below underlines the fact that almost half the SWIX is made up of ten shares. Conversely broader global indices are much more diversified. Kindly note this is not a SA or Emerging Markets (EM) problem. For those of us whose first cell phone was a Nokia, you might remember at its peak, the mobile company accounted for around three quarters of the Helsinki stock exchange (and we all know how that ended).

Similarly resources accounted for over half the FTSE/JSE All-Share Index in 2008. It therefore seems intuitive to invest in a global universe which mitigates concentration risk.

Conclusion

We believe investors should be looking at a broad range of benefits provided by offshore investments. Hedging against currency depreciation should not be the sole purpose. Spreading assets across several countries as well as accessing opportunities in sectors and companies which may not be available locally, just makes sense. Our status as an EM tends to make our exchanges more volatile than first world bourses and this is sometimes compounded by factors difficult to forecast like drought or politics.

A word of caution however – the next ten years may look very different to the past ten. The rand is considered one of the most undervalued currencies in the world. Any strength from current levels will undoubtedly have an adverse impact on future returns of non SA assets. While it’s notoriously difficult to forecast the rand, it’s worth highlighting it has historically bounced back from such extreme/oversold levels. To put it into perspective, I met up with colleagues after work and was amazed how cheap alcohol (and Big Macs) was in SA. This got me looking on Google where I found a survey on the cost of beer in a neighbourhood pub, which is cheaper in Johannesburg than anywhere in the world! According to www.expatistan.com a pint only costs a quarter of an equivalent beverage in London. I can endorse this survey and verify its accuracy so you can either drown your sorrows because the rand is weak or enjoy the quality of life. Either way a prudent approach to investing offshore from current levels would be to follow a staggered approach to increasing exposure.