STANLIB Multi-Manager Bond Fund – underlying manager changes

STANLIB Multi-Manager Bond Fund – underlying manager changes

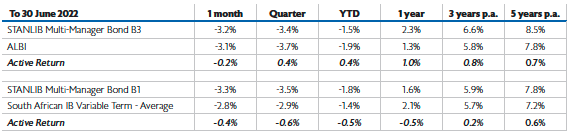

Fund performance relative to its objectives

The main objective of the STANLIB Multi-Manager Bond Fund is to outperform the FTSE/JSE All Bond Index (ALBI). Producing above average peer returns is a secondary objective.

As can be seen in the table, the Fund has delivered on its dual objectives. Its performance relative to the index benchmark is ahead in almost all of the periods shown. Relative to peers, though short-term performance has come down, the long-term performance picture is encouraging. Overall, we are satisfied with the performance of the Fund.

Reasons for removing Aluwani and Prescient

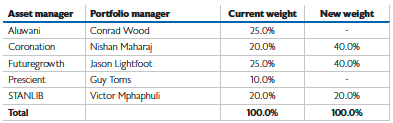

The primary reason for the change was a revised portfolio construct – given the lower assets under management, we felt it sufficient to have fewer managers. Considering this, we had the difficult task of selecting which managers to remove, and following an extensive review, we decided to remove Aluwani and Prescient.

Why Aluwani and Prescient? We have had a long and fruitful relationship with the two asset managers, spanning many years and we understand them very well. However, our analysis suggested that from a portfolio construction point of view, we could remove them without significantly altering the overall positioning, diversification, and prospects of the Fund. In addition, we were running a barbell strategy with the two managers’ portfolios where Prescient was the more aggressive, high-tracking error manager and Aluwani was more conservative with a low tracking error. Our analysis showed that the portfolio would struggle to achieve its risk and return objectives if we removed only one of them. Our manager assessment rating of Aluwani and Prescient remains high and we continue to partner with them in our other fixed-income funds.

In terms of current Fund positioning, not a lot has changed because of the decision. The Fund remains overweight duration with the remaining managers seeing value in long-dated bonds where yields are above 10%. The Prescient portfolio had high exposure to inflation bonds and Coronation, at a higher weight, compensates for those. Aluwani used several levers to produce its alpha and the remaining three managers also exploit some of those alpha sources. Furthermore, Futuregrowth also invests in unlisted credit, another differentiated source of alpha.

Strategic manager allocation

The remaining managers have been through our rigorous investment and operational due diligence process and are some of the highest-rated names in the South African asset management industry. We believe they will continue to deliver on the Fund’s dual objectives. Our ongoing investment management process helps us identify these managers and rotate at times when we feel appropriate. We are always on the lookout for good bond managers to add to our list of highly-rated managers and therefore, stand ready to make further changes where we deem it to be necessary.