STANLIB Multi-Manager SA Equity Fund – underlying manager change

STANLIB Multi-Manager SA Equity Fund – underlying manager change

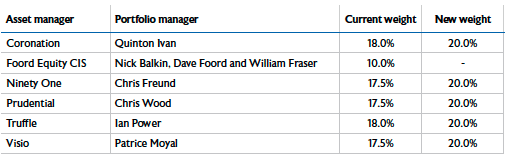

STANLIB Multi-Manager continuously reviews its funds to ensure that they remain positioned to deliver their objectives. Following our most recent review, our team decided to reduce the number of managers in the STANLIB Multi-Manager SA Equity Fund. The fund size is expected to reduce in the next few months and hence, the preference for fewer managers. This decision resulted in the removal of Foord Asset Management from the Fund.

Fund performance against its objectives

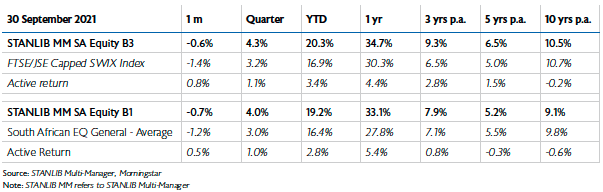

The main objective of the STANLIB Multi-Manager SA Equity Fund is to outperform the FTSE/JSE Capped Shareholders Weighted All Share Index (FTSE/JSE Capped SWIX Index), with a secondary objective of producing above-average peer returns.

As shown in the table the Fund has, over most periods, delivered on its dual objectives. Performance relative to the index benchmark has significantly improved over the past 5 years to the point where even the long-term alpha is showing good improvement. Relative to peers, performance is also pleasing especially if one considers that most peers in the category have offshore exposure and this Fund only invests in JSE-listed securities. Overall, performance is encouraging.

Reasons for removing Foord

The primary reason for the change was a revised portfolio construct. Given the anticipated future lower assets under management, we felt it appropriate to have fewer managers. This led to the difficult task of removing a manager and following an extensive review of the Fund, we decided to remove Foord.

Why Foord? We have had a long and fruitful relationship with Foord that spans many years and they are an asset manager that we understand well. However, from a portfolio construction point of view, our analysis suggested that we could remove Foord without significantly altering the overall positioning, diversification and prospects of the Fund.

We generally prefer managers that explore all parts of the market in their search for alpha and go wherever they see opportunities. Foord prefers a ‘buy and hold’ strategy and hunts in a very specific part of the market. This can be rewarding at certain points in the cycle but can also hurt for extended periods of time.

Given that we have a strong buy list of equity managers with which to construct our funds, at this point we feel the remaining five managers in the Fund are better placed to canvas opportunities across the broader market.

In terms of current fund positioning, some of the holdings in the Visio, Prudential and Coronation funds coincide with those in the Foord portfolio. This provides comfort that we are not necessarily foregoing some of the ‘pent up alpha’ in Foord’s portfolio. In addition, Foord’s mandate was the smallest in the Fund and was still on a performance fee arrangement. The SA Equity Fund does not charge performance fees. In addition, from an operational point of view, it was relatively easy to move the assets as we were invested in the collective investment scheme.

New strategic manager allocation