Tick all the right boxes – partnering with a multi-manager

Albert Louw

Head of Business Development

EXECUTIVE SUMMARY

- Partnering with a multi-manager ticks all the boxes, allowing financial advisers to offer clients a complete range of solutions.

- In the post Retail Distribution Review era, financial advisers cannot afford to provide investment advice without rigorous and up-to-date research and analysis. As a result, partnering with a multi-manager provider has become an increasingly attractive option for an adviser wanting to focus on providing high-level financial planning and demonstrate value-add through quality advice.

- Lastly, it is important to debunk the myths about multi-managers. Focus on the facts in your supporting documentation when advising clients on fees and performance outcomes.

Unpacking the benefits

Taking diversification one step further

Diversification goes beyond asset classes and strategies. Additional diversification is provided through a multi-managed blend of managers as clients are not fully exposed to a single manager that is going through a period of underperformance. This assists your clients in reducing investment risk and delivers more consistent outcomes.

Reduce complexity – selection of managers/funds part of the ‘package’

Quite simply, more choice creates complexity. Multi-managers research the universe of asset managers/ funds for new opportunities and potential replacements. Asset managers/funds are subject to rigorous screening processes, involving both quantitative and qualitative analysis, in order to fully understand their philosophies and processes. Through this, a view is formed on which managers are likely to outperform over the medium to long-term, and which managers should be avoided.

Expertise – how to put it all together

In terms of portfolio construction, clients benefit from the investment experience, resources, and knowledge of various managers/funds. Different managers, styles, teams and investment approaches are all blended into one solution.

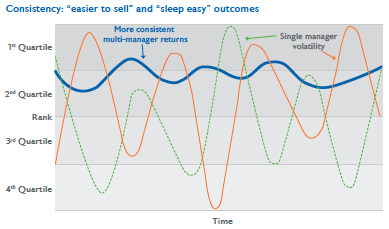

Consistency – less likely to be last or first

Performance consistency is key to the multi-manager value proposition. A better and more consistent outcome for your client promotes longer relationships and contributes to performing in line with client expectations. It also aligns better with a goals-based advisory approach.

Monitoring – single entry point

Multi-manager portfolios enable clients to track an extensive range of asset manager/fund investments through a single solution. Clients can have peace of mind in the knowledge that their appointed multimanager continuously monitors the underlying investments and manages the associated risk.

Lessen your (investment) advice risk

Multi-managers are well-positioned to assist advisers in an increasingly regulated environment. WHY – the General Code of Conduct (as per the FAIS Act) prescribes that a record of advice should provide sufficient detail to support investment recommendation(s). Multi-managers provide a detailed audit trail on decision-making processes, thus helping financial advisers mitigate some of their (investment) advice risks. The multi-manager performs the manager due to diligence, fund selection and construction frameworks for their respective solutions.

In effect, the adviser and client have mandated the multi-manager to be responsible for more than just asset allocation and stock selection decisions, but also selecting the right managers/funds and combining them in such a way so as to meet the longer-term goals of clients.

Dispelling the myths

Multi-managers are expensive. An additional layer of multi-manager fees DOES NOT necessarily translate into excessive fees.

Multi-managers give an average performance. NO – a multi-manager aims to deliver above-average performance more consistently over time.