Tax-Free Savings Accounts (TFSAs): How to select the most appropriate investment portfolio

Albert Louw

Head of Business Development

Executive summary

- A TFSA is a flexible and highly tax-efficient solution for discretionary savings

- Save for the long term (use your maximum annual contribution) to maximise the tax benefits – the longer the investment is held, the greater the (tax saving) benefit

- A TFSA is not suitable for money market / income type portfolio. The portfolio would have to deliver a return above the annual interest exemption to deliver a real benefit

- Investors would only benefit meaningfully once the value of the investment is sufficient to exceed the annual interest exemption

- Be disciplined and do not withdraw from your TFSA if you have other sources of income available.

Background

In 2015 National Treasury decided to incentivise South Africans to save more to address the underlying socio-economic problems that arise from our ¹poor savings culture. It introduced tax-free savings and investment vehicles. The TFSA is an ideal discretionary investment option to supplement your existing retirement and /or discretionary savings. A TSFA is completely tax-free. It reduces your taxable income while you invest. When you withdraw, you receive the full investment back, without incurring any tax on the growth.

Advantages and limitations

Advantages

- The investor’s growth is tax-free: the interest, capital gains, and dividends are completely tax-free;

- You can choose from a range of selected underlying funds that can meet your unique investment needs;

- You can access your investments whenever you need them. There are no penalties for withdrawing from your investment and you can change, stop and restart your debit order whenever you wish, at no extra cost;

- Flexibility – you can transfer savings from one provider to another, without it being seen as a new contribution. This increases competition among TSFA providers and helps to ensure that products stay competitive;

- Liquidity – you make a long-term investment into a TSFA, intending to leave it there for the long term, at least you have the comfort of knowing that if the ‘wheels do fall off’ and something unexpected does happen, you can access your money;

- Saving additional CGT – When you die, the value of the TSFA will be added to your estate. After the exemption of R3.5million, it will be subject to estate duty. However, the estate will not be liable for CGT when the investments in the account are sold (deceased estates are subject to CGT). Neither you nor your estate can transfer investments in a tax-free savings account to someone else. Your heirs can inherit the savings and transfer them to their own tax-free savings accounts, but the amount transferred will be regarded as a contribution by the beneficiary to their accounts and will count towards their annual and lifetime limits;

- Saving on executor fees – If a life assurance investment policy is an underlying investment in your tax-free savings account and you nominate a beneficiary, the proceeds from the policy can be distributed to him or her before your estate is wound up. This will save executor’s fees.

- The maximum amount you can currently invest is R36 000 a year or R3 000 per month with a lifetime maximum of only R500 000;

- You will incur a penalty of 40% of any amount you invest above the maximum.

BUT what investment portfolio to consider?

When selecting a TFSA, it’s important to ensure it fits within a holistic long-term financial plan.

The (1) first step is to ensure the investor’s discretionary investment goal is mapped against the appropriate portfolio – choose the portfolio that is suited to your investment objective.

(2) Secondly, to maximize your after-tax return, you may want to consider a TFSA or what is sometimes referred to as “tax-free wrappers”, to achieve medium to long-term investment goal(s).

TFSAs are NOT intended for short-term savings such as money market/call account investments

If you are not already paying tax on your investments, or are not investing for the long term, the TFSA may not provide significant tax benefits. You would only benefit meaningfully from the tax-free treatment of money in the TFSAs once the value of the investment is sufficient to exceed the annual interest exemption. Consider that the current annual interest exemption for people below age 65 is R23 800 per annum and this is not going to be increased in the future. If you are younger than 65 and select only interest-bearing investments earning, say, 7% a year, the investment would have to be worth ²R340 000 before the interest exemption is exceeded.

The real value of your tax savings on a TFSA needs time to compound. So if you contribute to a TFSA and withdraw that money in two years’ time, you will have used up two years of contribution limits, but you’ve actually gained very little in the way of tax savings.

You should have a 10-year or longer investment horizon when choosing a tax-free savings account. Investors sometimes think because it’s an account, it has to be held in the form of a bank or fixed deposits. It is important to consider very long-term investments, in other words, things like investments in shares or listed property, or balanced unit trusts. The longer you remain invested, the greater the (tax saving) benefit As with all worthwhile things in life, patience and discipline are vital.

The longer you remain invested, the greater the benefit

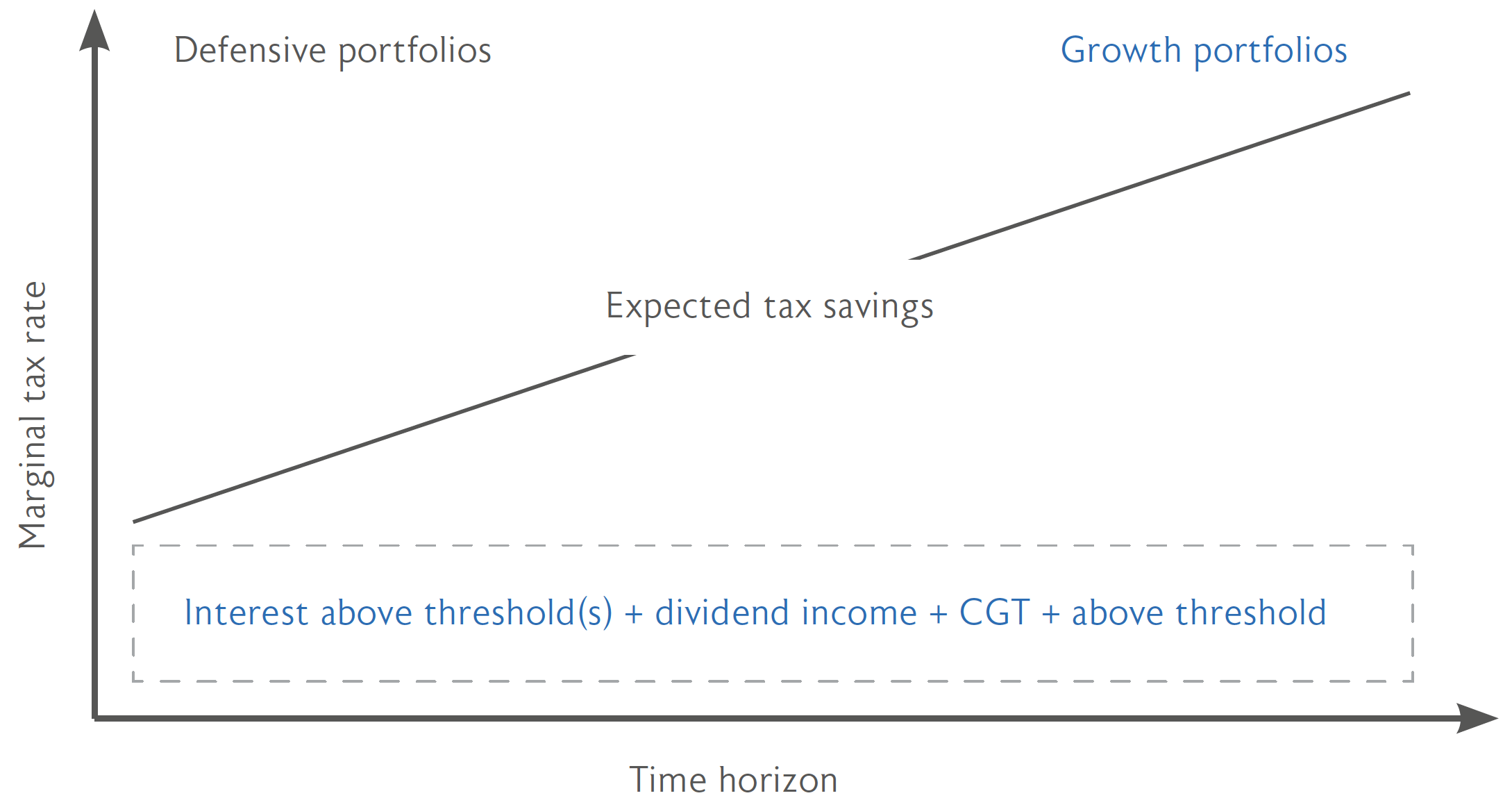

As with all worthwhile things in life, patience and discipline are vital. The longer you remain invested, the greater the benefit from tax-free growth – so target a term of at least five to ten years or longer. The extent of the tax-saving will vary significantly across the universe of portfolios available. It depends on a combination of factors, the primary two, being:

1. Your marginal tax rate, and

2. The type and amount of income and capital gains earned from your selected portfolio.

Time horizon growth portfolios typically have most of their assets invested in equities, including listed property. Equity dividends received from shares, both locally and offshore, exempt from paying 20% dividend withholding tax (DWT). On the other hand, taxation of ³REIT dividends are taxed at your marginal rate but in a TFSA are tax-free. 4Research shows that property as an asset class typically has the greatest tax saving regardless of your marginal tax rate. Property distributions i.e. dividends are paid from pre-tax profits and typically produce higher dividend yields than equities.

The saving on DWT, and relatively high property distributions (‘dividends’) in growth portfolios make them ideal long-term investments for tax-free savings accounts.

The CGT saving is underestimated when the investor decides to sell all or part of a non-tax free investment

Any capital gains must be declared to SARS and if they are above the tax threshold of R40 000 you will be liable for tax on your return calculated according to your marginal income tax rate.

For instance, the current capital gains tax exclusion is R40 000 per year. If you chose investments with strong capital growth it could potentially exceed the capital gains exclusion within five years. That means you would be better off having this money in a TFSA. The tax saving (i.e. capital gains tax) when ‘cashing- in’ your investment at the end of your savings term, should not be underestimated.

Example:

The investor realizes the full extent of the cost of education once a child starts school. So he decides to invest the full annual tax-free allowance of R36 000 every year for 13 years, which means that he would have contributed a total of R468 000 over the period – this is very near the current maximum R500 000 lifetime limit. If the annual R36 000 was invested in a high growth multi-asset portfolio and achieved a 5real return of inflation plus 6% over the 13 years it would have grown to R1 116 627 when the investor decided to sell his investment to pay for the children’s education (‘he would have doubled his investment’).

The capital gains tax saving of *R110 000 is substantial by comparison with a non-tax-free investment portfolio. The investor would therefore have notched up an extra R110 000 for school education at the end of the 13-year investment term solely as a result of the tax-free benefits of this vehicle. This would be a substantial bonus for anyone saving for a specific goal such as education.

*R1 116 627 – R468 000 = R648 627

Min annual exclusion: R40 000

Capital gains of: R608 627

CGT (618% x R608 627) = R109 553 ~ R110 000

A TFSA is a ‘no brainer’ – on condition you put savings into the right vehicle and for the right reasons

TFSAs are a great solution to South African’s poor savings culture. Investors should take advantage of the opportunity to grow their savings without paying any interest, dividends, or capital gains. If used wisely, TFSAs can have significant and positive long-term financial consequences. The key is to start contributing as soon as possible. It is also important to contribute the maximum allowed each year. The tax saving will compound returns in the long term.

The investor’s marginal tax rate and type of portfolio should be carefully considered, as should their existing retirement and/or discretionary savings.

1According to the 2017 Old Mutual Savings and Investment Monitor, only 15% of household income is allocated towards savings.

2R340 000 = 7%/23 800.

2A Real Estate Investment Trust (REIT) is a listed property investment vehicle that publicly trades on the JSE board and qualifies for the REIT tax dispensation. REITs must pay at least 75% of their taxable earnings available as a distribution to their investors each year.

4(1) MoneyMarketing publication (February 2018) – Tax-free investing Feature (2) Nedgroup Investments (Q1 2015) – The new tax-free savings account: how much will you actually save?

5Assume the portfolio achieved an annual return of 12% (with inflation at 6%).

6Assume highest tax bracket of 45% x 40% inclusion rate.