GenNext (Generation Next)

It does not feel like it was so long ago when the South African asset management industry was starting to experience a substantial rise in boutique asset managers. Now in their late teens, with some going into adulthood, we – over a three-part series – look back at the journey of the pioneers who left large investment houses to manage money within a boutique setting. We look at how the landscape influenced their voyage and how they, in turn, have shaped the environment and what their future may look like.

The STANLIB Multi-Manager team is drawing some succinct insights by studying boutique managers that have been in operation for seven years or more. We acknowledge that the description of who qualifies as a boutique manager differs widely, however, we have chosen generally accepted characteristics – owner-managed firms with a focused investment offering run by smaller teams of specialists and managing R50 billion or less.

On reflection, we are reminded of the numerous studies and debates that have gone on over many years, around the role played by nature (DNA) and nurture (society) in shaping us as individuals. We also cannot help but muse on current technological advances that have moved from the ability to read DNA sequences, to introducing techniques for the editing of DNA.

We acknowledge that there are some characteristics that may persist between large and boutique managers (“inherited”), while there are some that come and go. We look at how much of what the boutique managers have become was written in their “genes” and how much has arisen from elsewhere.

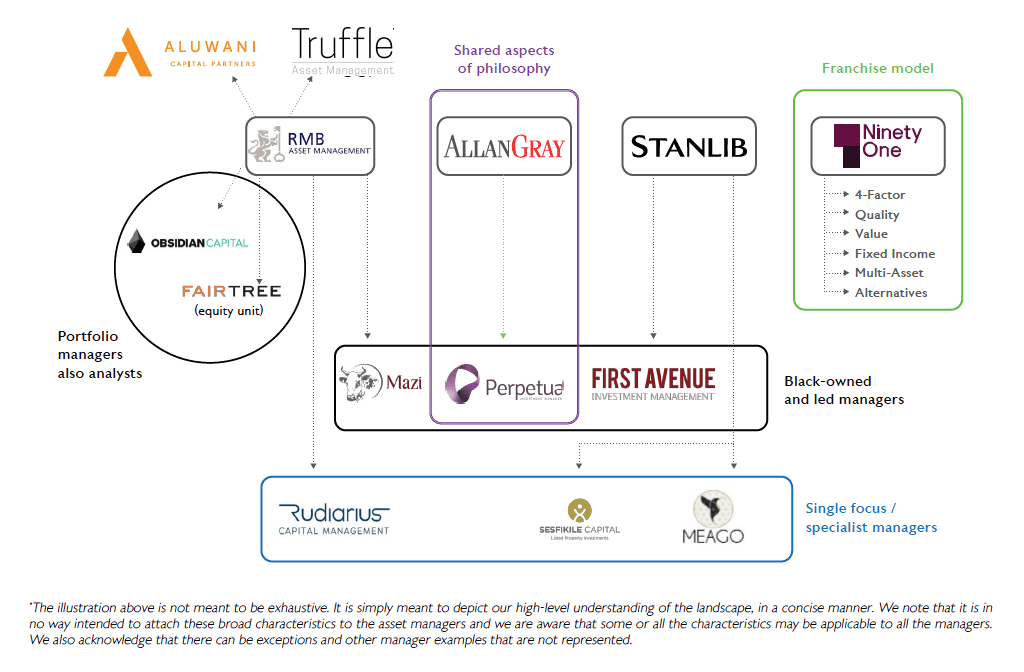

In this first edition, we pay attention to the role played by large investment houses – how they built up experienced individuals who went on to open their own firms; or how they created environments within their firms that are conducive for those with entrepreneurial qualities. We consider how boutique managers are not subjected to forced inheritance, although we note some aspects of shared DNA. We touch on some of the names in the asset management industry to illustrate our insights, with the view to expanding with other examples in the upcoming two editions.

Part 1: CUT, PASTE, LIFE – the role of large investment houses

Building experienced individuals

The US National Library of Medicine defines genes as “a set of instructions that determine what the organism is like, its appearance, how it survives, and how it behaves in its environment. Genes are made of a substance called deoxyribonucleic acid, or DNA.” Stated another way, our genes or DNA carry information that determines who we are, what we look like and many other traits that are passed down from one generation to the next in a family. Although this is a simplification of reality, it is an appropriate analogy.

This can also be said for a large proportion of boutique asset managers, whose investment experience was to some extent shaped during the years spent in larger, more established asset management firms where they initially came from.

Most of these individuals have become well-rounded investment professionals. Their experience as analysts while at the large houses has become invaluable, with most guiding the modelling and analysis responsibilities in addition to being portfolio managers at their boutique firms. Their grooming of the next generation of analysts enables the skills build-up and skill transfer in the industry, which is generally very positive.

Shared aspects of the investment approach and business processes

We also see traces of this extensive experience in some boutiques keeping the philosophy unchanged, while others incorporate certain aspects of a particular investment style. As an example, Perpetua Investment Managers focuses on investing along the full value spectrum, which has its roots in Allan Gray’s traditional long-term value-oriented philosophy. This is not too different to gene editing where the boutique manager is able to keep, remove or modify the inherited genes in order to best express their own identity.

In addition, as the boutique business grows in assets or public recognition, the need to have clearer lines of responsibility arises and this generally calls for the introduction of more institutionalised structures and frameworks. Thus, it can be said that the larger managers set the tone on how to devise clear business strategies and formalise some of the investment processes that are widely followed by boutique managers.

Industry’s entrepreneurs and intrapreneurs

Despite some even being influential in establishing the larger investment houses, the boutique managers have responded in large numbers to their entrepreneurial flair for several reasons. These include, among others, the need to create substantial wealth for themselves or to leave a legacy; or simply to be independent. Examples of these are Truffle and Obsidian, who were part of the ex-RMB Asset Management team.

We also see how some well-established houses have been fertile ground for corporate entrepreneurs within. Here, through the franchise models, unique and specialised investment approaches and strategies are offered under one roof. Just as we embrace that no two children from the same family are alike, there are genetic differences and each can be allowed to showcase their individuality.

In addition to assisting the business to not become vulnerable to a specific investment strategy coming under pressure – especially during periods of underperformance – this model of running a multi-strategy asset management firm allowed for the retention of talent while promoting freedom of thought among the various investment professionals, with each heading their individual units or product. As with a boutique setting, the small and simple franchise structures also intend to help avoid distractions from investment activities while leveraging off the shared operational support of larger, more complex investment management businesses.

The co-ownership of business units also serves to closely align the interests of portfolio managers with those of the underlying clients, as well as providing incentives for long-term performance and the stability of these teams. These organisational silos that operate independently, are similar to having boutique asset managers within a large manager. Examples include Ninety-One who runs a franchise model made up of six unique capabilities, each with its own global and regional strategies; and Old Mutual Investments, which has five distinct investment businesses. STANLIB Asset Management is another example, with seven unique investment teams.

Formation of boutiques with specialised offerings

Large houses can also be likened to incubation machines, where some distinct capabilities were kept warm at a particular temperature range and in the correct humidity – forming, growing and developing – until they were ready to be pursued as stand-alone offerings by the boutique managers. Examples can be found at houses that have a singular specialisation, such as Rudiarius Capital Management, an Africa-only manager or property managers like Sesfikile Capital and Meago Asset Management, that broke away to fully focus on specific markets.

Contribution to important industry matters

Other considerations include the great efforts that continue to be made within the asset management industry to have businesses and teams that are more diverse and representative of our country. In some instances, these important agenda matters – transformation, ESG and gender diversity – may not be the key focus areas of boutique managers, or they may not have formalised plans to address them, especially at an early phase of the business.

Although there is still room for improvement within the industry, we note that some of the strong black investment professionals that own and manage boutiques came from large houses. Thus, in such cases, the large managers indirectly contributed positively to the broader transformation agenda of asset management. Some examples of black-owned and led asset managers are Mazi Asset Management, First Avenue Investment Management and Aluwani Capital Partners.

Just like a family that shares DNA, a decent reflection of variation and diversity is important. To develop solutions that will benefit the broader community of investors, the asset management industry must include people from a range of backgrounds.